Alliance Report

January 2, 2026

Issue 26/1

The leading voice of nonprofits on postal issues for over 45 years.

Copyright 2025: Alliance of Nonprofit Mailers—All rights reserved.

The Alliance of Nonprofit Mailers is a 501 (c)(4) nonprofit organization established by nonprofits for nonprofits.

New Year, Same Challenges

Today marks the first business day of 2026, a New Year. 2026 will bring much to the postal table, and the Alliance will continue to ensure that our members have the information they need to make informed business decisions. Unfortunately, while we welcome a new year, we will continue to face old challenges in 2026. Here are just a few things we see on the horizon for 2026 that will require our attention and action:

Continuation of the Postal Regulatory Commission’s (PRC) review of the USPS rate making system. This review is the most important activity for our association because it can directly impact the prices the USPS can charge in the future.

The PRC in 2025 began a “phased” approach to the rate review, publishing two proposals for change (limiting the USPS to one price change per calendar year and adjusting a workshare discount loophole) – but the PRC has not yet issued its decision on those proposals. It is worth noting that in its FY2025 Annual Compliance Report (ACR) (see below article), the USPS included the required Updated Schedule for Regular and Predictable Rate Adjustments. In the schedule, the USPS states that it plans to implement the next price adjustment in July 2026, and while it acknowledges the open proceeding at the PRC which could change its plans, the USPS states that it “intends to continue with the practice of implementing up to two price changes a year.” We expect the PRC in 2026 to issue a decision on the initial two proposals as well as initiate subsequent phase(s) of the review.

In addition, the USPS last week filed 2 petitions with the PRC related to the rate review (see Alliance Report 12-25, published 12/22/25). The USPS is requesting that the PRC eliminate the CPI price cap system or allow a “rate reset” to give the USPS additional rate authority (which the USPS estimated at 22% over the period of the rate system review), and also asked the PRC to eliminate the requirement for the USPS to make annual payments for future retiree health benefits and pensions in order to help the USPS’ liquidity position in the short term.

The bottom line is that there are many directions the PRC could choose to take in its next steps in the rate review process, including not only the above, but also review of the density additional rate authority or other rate authority mechanisms.

USPS Proposals to Change Cost Methodologies. As mentioned in our Alliance Report 11-25, published 12/4/25, the USPS filed a progress report at the PRC laying out its plans for short-, medium- and long-term initiatives it plans to pursue on costing methodologies or other data changes that can impact workshare discounts. Included in those initiatives we could see pursued by the USPS in 2026 are changes to costs based on the changes to the USPS’ network and mail flow; updated labor productivity cost models; and potentially studies around Undeliverable-as-Addressed (UAA) mail costs.

Unfinished Business from 2025. In addition to any new filings from the USPS, or continuation of the PRC’s rate system review, there are a few unfinished dockets still open at the PRC, waiting for a final decision from the regulator. The USPS proposed changes to Undeliverable-as-Addressed (UAA) cost methodologies, which would negatively impact presort workshare discounts, have not yet been decided by the PRC, and there are other open proceedings around USPS’ service performance measurement that may be decided in 2026.

July 2026 Price Change. The USPS is expected to file in April for a July 2026 price change. Based on known data so far, the increase will be around 5% for most Market Dominant mail classes (7% for Periodicals, Marketing Mail Flats, and other products that do not cover their costs). We won’t know the actual price increase until the USPS files at the PRC in April, but we will keep members up-to-date as the USPS shares updated projections. And of course the devil can be in the details, since individual products can see price increases that are more or less than the average for the mail class as a whole… In addition, the Alliance always double-checks the math that Nonprofit postage rate increases are being done in compliance with the applicable statutory formulas.

And there is always the unknown… As the USPS continues to experience financial pressures, there may be other changes it proposes that may or may not be in the best interests of Alliance members. As always, we remain vigilant and will monitor activity at the USPS, the Postal Regulatory Commission (PRC) and on Capitol Hill.

In order to continue our work as the only association focusing on Nonprofit Mail and working to protect Nonprofit postage rates, we need to collectively work to keep the Alliance strong. You can help with this goal by spreading the word about the good work we are doing to your nonprofit organization peers who may not be Alliance members. You can also reach out to your suppliers if they are not already Alliance sponsors, and encourage them to support the association through sponsorship. If you need membership or sponsorship information or application forms, please contact kathy@nonprofitmailers.org.

USPS Files FY2025 Annual Compliance Report

The USPS on December 29, 2025, filed its Annual Compliance Report (ACR) at the Postal Regulatory Commission (PRC). The USPS is required to submit the report each year and provide a variety of data on costs, revenues, rates, and quality of service, in order to “demonstrate that all products during such year complied with all applicable requirements” of Title 39.

FY2025 Revenue Up but Volume Down. The USPS’ total revenue for FY2025 was $81.3 billion, a 1.1% increase over the prior year. First-Class Mail revenue was 1.7% above the prior year but volume was 5.2% below the prior year. Marketing Mail revenue was 2.9% above the prior year but volume was 1.3% below the prior year. Revenue from Competitive Services products (parcels) was 0.1% over the prior year while volume was 9.4% below the prior year. Total volume was 106.6 billion pieces, a 3.4% decrease from the prior year.

Prequel to Next Price Change. The FY2025 ACR provides data that, if approved by the PRC, will be used by the USPS in its next price change (reportedly to occur in July 2026). For example, mail classes and/or products that are found to not be covering their costs will be assessed an additional 2% price increase. The USPS in the FY2025 ACR identifies Marketing Mail Flats, In-County and Outside County Periodicals, and Alaska Bypass as products that did not cover their costs.

The FY2025 ACR also identifies the amount of the “density” additional rate authority the USPS has available for its next price change as 2.19%. This percentage will be combined with the CPI data to determine the magnitude of the next price change.

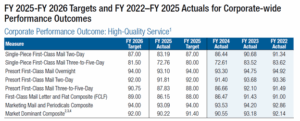

FY2025 Service Performance. Included with the ACR Report and dozens of Library References the USPS files at the PRC as part of the ACR process is a report to Congress which includes the USPS FY2025 service performance as well as its FY2026 performance plan. The USPS in FY2025 did not meet any of its “corporate-wide” service performance targets (as shown below) and performance for most categories did not exceed that of FY2024.

The USPS’ service performance targets for FY2026 (which began Oct. 1, 2025) in many cases are unchanged from its FY2025 targets, though the USPS increased the target for First-Class Mail with 3-5 day service standards.

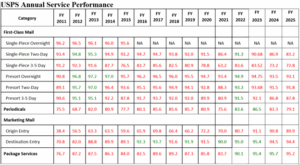

Above is a chart prepared by the Alliance that shows the USPS’ annual service performance targets since FY2019. It should be noted that the USPS does not publish certain performance targets (not shown above for FY2026) until it files the first quarterly reports at the PRC for the Fiscal Year. In addition, the grey boxes in the chart above indicate periods where the USPS did not establish performance targets at that level.

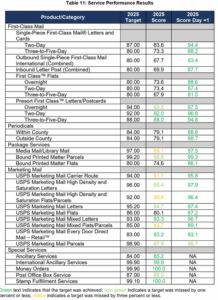

The USPS in its report to the PRC includes the below chart which shows performance at the finer product level, and by service standard. In a disingenuous use of color, the USPS shows “green” performance in the far right column, but this is what would have been achieved for each category with an additional day. The middle column shows the actual scores, with light green indicating that the target was missed by one percent or less, yellow indicating the target was missed by 3% or less, and green indicating that the target was met for FY2025.

To put the USPS’ annual service performance targets into perspective, the below chart prepared by the Alliance shows the major product categories and actual USPS annual service performance from FY2011 through FY2025, with green indicating where the USPS achieved its service performance target for that year and red indicating where it did not meet its annual target.

USPS Cost-Cutting Initiatives – Any Progress?

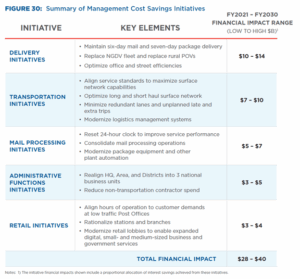

One of the cornerstones of the USPS’ Delivering for America (DFA) plan was the “self-help” cost “improvement” initiatives the USPS included in the plan, which it projected would total $34 billion. The USPS said in the 2021 plan that these cost savings initiatives would be mail processing, transportation, retail, delivery and administrative efficiency.

The below chart included in the FY2021 original DFA plan provides more detail on the cost improvement initiatives.

The USPS in 2022, 2023, and 2024 published annual updates to its Delivering for America plan, though none specifically addressed its progress on the $34 billion “self-help” cost improvement initiatives detailed in the original plan. The USPS did not publish an update to the DFA in 2025.

Noting that the DFA is a 10-year plan that runs through 2030, we are now concluding the 4th year of the plan, so some progress should be made towards these USPS cost improvement initiatives. To the extent high level information is publicly available to assess progress, here is what can be seen.

Delivery Initiatives. The USPS’ DFA plan includes $10-14 billion in delivery cost improvement. Looking at publicly available data on USPS delivery, the total number of delivery points served by the USPS increased to 170.3 million compared to 163.1 million in FY2021, an increase of about 5% or 7.2 million. The number of routes served by the USPS went from 233,171 in FY 2021 to 236,347 in FY2025, an increase of 3,176 routes (about 1.4%).

While the number of part-time/non-career carriers declined between FY2021 and FY2025 through the USPS career conversion plan, the number of full-time carriers increased. The number of city delivery carriers went from 172,894 in FY2021 to 178,026 in FY2025, and City Carrier Assistants went from 37,653 to 23,921. The number of full-time rural carriers went from 75,134 in FY 2021 to 81,785 in FY2025 and part-time rural carriers went from 54,110 to 46,870. Labor productivity went from 62.3 in FY 2021 to 51.4 in FY2025.

Transportation Initiatives. The USPS cost improvement for transportation is $7-10 billion in the DFA. Since 2021, the USPS has saved about $1.259 billion total in transportation costs, and noted in its FY2025 ACR, that it projects no additional transportation savings in FY2026, stating “[t]ransportation expenses are planned to remain the same, due to ongoing transportation modality changes supporting service and reducing costs, decreases due to insourcing of contracted employees, and market fluctuations for resources such as fuel and drivers which impact costs.”

Mail Processing Initiatives. The USPS’ DFA includes $5-7 billion in mail processing cost improvement. Activities noted in the DFA include resetting the 24-hour clock to improve service performance, consolidating mail processing operations, and modernizing package equipment and other plant automation. As can be seen by the earlier article on the USPS’ Annual Compliance Report in terms of service performance, there has been little improvement there. Mail processing workhours (clerk/mailhandler hours) in FY 2025 were 326.9 million compared to 416.1 million in FY2021, and supervisor (all supervisors) workhours were 57.9 million in FY 2025 compared to 55.0 million in FY2021.

Administrative Functions Initiatives. The USPS’ DFA includes $3-5 billion in mail processing cost improvement and mentions realignment/reorganization structure changes as well as reduction in non-transportation contractor spend. While it is difficult to find any publicly available data on this activity, it can be seen that USPS Headquarters/field support unit employees went from 9,177 in FY2021 to 10,844 in FY2025, and total field employees went from 504,085 in FY2021 to 517,180 in FY2025.

Retail Initiatives. The USPS’ DFA includes $3-4 billion in retail cost improvement and mentions actions such as aligning hours in low traffic offices to customer demand, rationalizing stations/branches, and expanding business and government services. In FY2025 the USPS had 4,825 stations, branches and carrier annexes, compared to 4,885 in FY2021. There were 26,147 post offices in FY2025 compared to 23,362 in FY2021.

The Bottom Line. Total USPS operating expenses in FY2021 were $89.7 billion in FY2025 compared to $81.8 billion in FY2021, an increase of $7.9 billion (9.6%). Total mail and package volume declined by 16% in the four-year period, while total workhours only declined by 4.8%.

On Dec. 15, 2025, the Government Accountability Office (GAO) issued a report (see Alliance Report 12-25, published 12/22/2025) on the USPS’ financial condition where it recommended the USPS make publicly available its financial projections – a recommendation the USPS disagreed with.

Postmaster General Steiner has publicly said that the USPS can’t cost-cut its way to profitability…but he agrees that there is cost cutting the USPS can do… It would go a long way with stakeholders, including Congress, to see if the USPS has made progress on the initiatives its DFA plan laid out as $34 billion in “self help.”

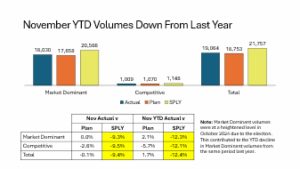

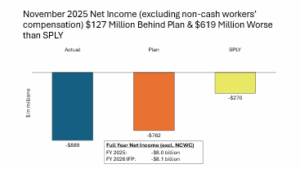

USPS November Financials Show Revenue & Volume Down from SPLY and Plan

The USPS recently filed its November 2025 financial results, which show that both revenue and volume are down compared to the Same Period Last Year (SPLY) and to the USPS’ Plan. The below charts provide some detail:

Brookings Institute Looks at Postmark Change

The USPS published final rules in the Federal Register back in November 2025 adding a section to the Domestic Mail Manual (DMM) that “defines postmarks, identifies the types of Postal Service markings that qualify as postmarks, and describes the circumstances under which those markings are applied.” The final rule is effective December 24, 2025.

The USPS stressed that “[t]his new language in the DMM does not change any existing postal operations or postmarking practices, but is instead intended to improve public understanding of postmarks and their relationship to the date of mailing.” While on its face, that is technically true, there has been a recent operational change that, when combined with the postmark policies, has an impact on the general public as well as businesses and entities that use the postmark to prove date of mailing. When the USPS implemented its Regional Transportation Optimization (RTO) initiative, the result was that for post offices more than 50 miles from a Regional Processing and Distribution Center (RPDC), the USPS would go from 2 pick ups a day (morning and afternoon) to one pick up a day (morning) of blue box collection mail and other outgoing mail from that post office. Before this change, mail picked up on the 2nd later pick up would be transported to the local processing center where it would be canceled (postmarked) with the same date. Under the new RTO policy, mail that is deposited in a blue collection box at the same post office would not be collected until the following collection day, then transported to the processing center where it would be canceled, so there could be 1 or more days between when the piece is “mailed” and when it is postmarked.

Every day there have been more local news articles about this change and its impact, advising consumers to mail certain things early to ensure a postmark prior to a deadline, and now the Brookings Institute has published a paper looking at some of the impacts. “For more than 70 years,” it said, “legal and administrative systems have treated a postmark as reliable evidence of when an individual met a deadline: when a ballot was mailed, when a tax return was filed, when a court document was submitted, or when an application was received.” Brookings details how various systems utilize the postmark, such as elections, federal tax filings, Administrative agencies and other legal and private rules around postmarks. For Nonprofit organizations, the IRS uses the USPS postmark date for mailed donations to determine the tax year of the donation.

Trend Tracker Survey Reports on Consumer Attitudes Towards Print & Paper

Two Sides North America has published the results of its 2025 Trend Tracker Survey, which reports on consumer attitudes “toward print, paper, paper-based packaging and tissue products, revealing both challenges and opportunities for the print and paper industry.” Two Sides North America is part of the non-profit Two Sides global network which includes more than 600 member companies across North America, South America, Europe, Australia and South Africa. Its mission is “to dispel common environmental misconceptions and to inspire and inform businesses and consumers with engaging, factual information about the environmental sustainability and value of print, paper and paper-based packaging.”

A few highlights from the 2025 survey results:

- 78% of respondents want the right to choose how they receive their bills and statements; printed or electronically.

- 53% prefer to read books in print.

- 55% of respondents say they don’t pay attention to most online marketing advertisements.

- 48% prefer to read magazines in print.

- 52% prefer products ordered online to be delivered in paper packaging.

- Only 15% understand the paper recycling rate exceeds 60% in U.S.

The 2025 research “includes national representative insights from 12,400 consumers from the United States, Canada, Europe, including Austria, Belgium, Denmark, Finland, France, Germany, Italy, Norway, Sweden and the United Kingdom, as well as Argentina, Australia, Brazil, New Zealand, and South Africa.”

Into the Postal Weeds…

For those who live in the “postal weeds,” and are looking for news on mail entry, preparation, discounts, incentives, and more, this new column in the Alliance Report will be right up your alley! We won’t go all the way into the weeds…but we will offer up highlights on useful resources and mailing standard changes going forward.

- USPS Final Rule on Shape-Based Labeling Lists. The USPS published a final rule, effective Feb. 1, 2026, implementing shape-based labeling lists for SCF letters, flats and parcels. [Note that the implementation date was corrected in a subsequent notice by USPS to be 2/1/26 vs 2/1/25 which appeared in the final rule.]

Alliance Educational Webinar 1/22/26 – Register Now!

The Alliance will be kicking off our new webinar series in 2026 with a great primer, “Nonprofit Postage Rates – Past, Present and Future,” where we will talk about the evolution of the laws and policies governing nonprofit rates in the past and those that apply today, as well as what to expect in the July 2026 USPS price change.

The webinar will be held on Thursday, Jan. 22, 2026, from 11-12 EST. This first webinar will be open to all, so please share the information within your organization and with your nonprofit peers. Registration is open at https://zoom.us/meeting/register/zvXk8r-ESSqgMdI-7bPgCw.

The Alliance is planning to hold more webinars in 2026, some will be restricted to Alliance members only, others will be open to all. If there are specific topics or speakers your organization is interested in having a webinar on, email me at kathy@nonprofitmailers.org.

The Alliance is planning to hold more webinars in 2026, some will be restricted to Alliance members only, others will be open to all. If there are specific topics or speakers your organization is interested in having a webinar on, email me at kathy@nonprofitmailers.org.

Leave a Reply