March 21, 2019

(c) 2019 Alliance of Nonprofit Mailers–May be republished with permission and attribution.

Recently, we listened to a podcast of one of our favorite NPR shows, “Hidden Brain.” It is called, “How Science Spreads: Smallpox, Stomach Ulcers, And ‘The Vegetable Lamb Of Tartary’.” What has this to do with nonprofit mailers and the U.S. Postal Service, you ask. Well, the description of how all of us rely on other people, usually considered experts, to tell us things we come to accept reminded us of the current set of accepted facts about the USPS. And the research into why certain “facts” come to be widely accepted, and later proved wrong, helped us to understand the gap we believe currently exists between reality and the widely accepted and repeated diagnoses about the Postal Service.

A Senate oversight committee hearing last week demonstrated the degree to which so many people seem to accept the same “facts” about USPS, while there is a distinct lack of consensus about what to do about our postal system. Three of the four witnesses were dedicated career government employees, and the fourth was an accomplished business executive, now an appointee at the Office of Personnel Management. (None represented the interests or the experience of full-time employees or professional customers of USPS, who provide about 90 percent of the funding.) Only six of the 14 Senators on the committee participated, and none offered comprehensive solutions.

Senate Witnesses

- Gary Grippo, Deputy Assistant Secretary for Public Finance, U.S. Department of the Treasury

- The Honorable Robert G. Taub, Chairman, Postal Regulatory Commission

- The Honorable David C. Williams, Vice Chairman, Board of Governors, USPS

- The Honorable Margaret Weichert, Deputy Director of Management, Office of Management and Budget and Acting Director, Office of Personnel Management

The combination of the hearing and the podcast prompts us to offer our take on a few USPS myths, or postal vegetable lambs.

USPS Myth #1: Unless we act quickly, we will need a “taxpayer bailout” of USPS.

“Taxpayer bailout” is a value-laden term with very negative implications. Its continued use in the USPS context is very inaccurate and unhelpful. A taxpayer bailout usually refers to the government coming to the rescue of a private-sector shareholder-owned corporation.

The nonprofit ProPublica maintains an updated list that currently shows 980 recipients of taxpayer bailouts totaling $632 billion. Most of the recipient corporations have paid back the government with a positive return. The current net gain for the government is $107 billion. So, it turns out that taxpayer bailouts are not so bad for the government. They keep important businesses in business, and they return a profit to taxpayers.

But we are not advocating a taxpayer bailout for USPS because that’s not what it would be. And help from taxpayers is not likely to be needed, as we will address in the context of other myths.

USPS is owned by the citizens of the United States, not by shareholders or private owners. The Postal Service is funded by the users of the mail and package services, most of whom are U.S. citizens or companies and organizations that employ U.S. citizens. All U.S. citizens and residents benefit from the USPS, even those who pay little or no postage. The Postal Service already receives benefits from U.S. taxpayers, the largest being exemption from taxes, something nonprofit organizations also receive.

To call increased U.S. taxpayer largesse for the USPS a “bailout” is a nonsensical, circular argument. Yes, there would be a shift in amounts among the citizens who fund the public service agency. That’s similar to any revision to our tax laws, or to differential postage rate increases for different types of mail. But it would not be a “bailout” of the private sector by the government.

We have one final point on taxpayer involvement in our postal system. The Post Office Department was started by Congress in 1792, which is 227 years ago. The Postal Service continued to receive public service appropriations funded by taxpayers into the early 1980s. So, the experiment with a mailer-funded postal system has lasted only about 35 years, or 15 percent of its history.

The mailer-funded system worked mainly because mail volume doubled from 100 billion in 1980 to 200 billion in 1999. (19 years at that growth rate represents only 8 percent of our postal system history.)

Adjusting the dial toward more government funding would be a rational response to the learnings from our brief experiment with a mailer-funded system. It would be a return to the model that has worked for 85 percent of our history, not a “taxpayer bailout.” But it’s not likely to be needed.

USPS Myth #2: USPS is losing billions and has done all it can without external help.

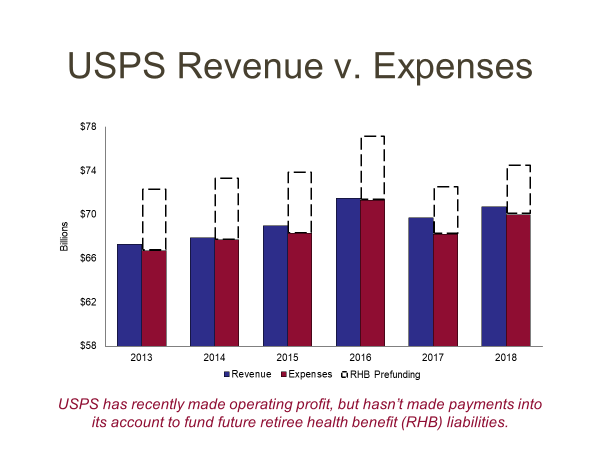

The reality is that the Postal Service is making operating profits and its reported losses are primarily caused by unpaid retiree health benefit obligations. The most recent six years show that the Postal Service is covering its operating costs, but not by enough to pre-fund health benefits.

Sources: USPS Annual Compliance Reports, USPS Public Cost and Revenue Analysis Reports, USPS 10-K Reports (about.usps.com)

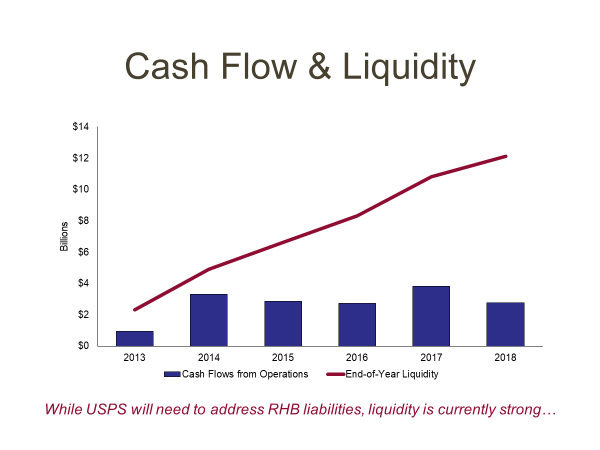

USPS cash flow from operations and year-end liquidity reflect the positive operating results.

Sources: USPS 10-K Reports (about.usps.com)

So, while current operations are strong, the USPS needs to make more of an operating profit to pre-fund what it will pay for its employees’ retirement benefits in future years. We will address whether the pre-funding is as big of a problem as people say, but first, how does a business rev up its operating net income?

The answer is that it makes sure its revenues grow sufficiently faster than its costs. And in today’s hyper-competitive, low-inflation economy, most of the work is done on the cost side, especially for a mature business with a growing number of alternatives. The mail side of USPS is mature, while the shipping side is high-growth with competitive advantages.

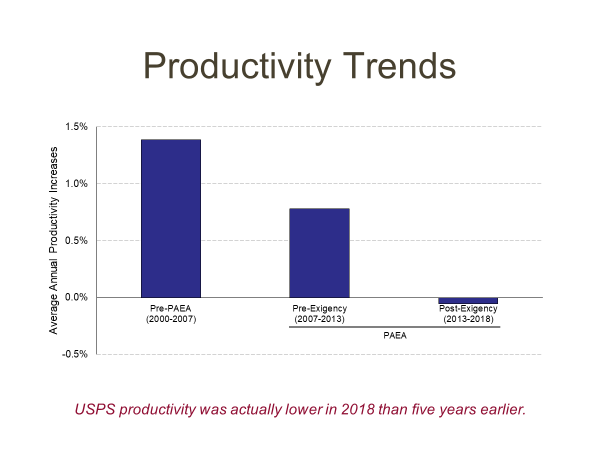

The most comprehensive measure of what USPS needs is productivity, what it gets for what it spends. Unfortunately, Postal Service total factor productivity has dropped off the table in recent years.

Source: USPS Annual Tables, FY 2018 TFP (Total Factor Productivity)

What USPS needs most, it is not doing. It is well documented that the Postal Service virtually stopped major cost-reduction initiatives several years ago. This could be due to several factors: political pushback, lack of a board providing strategic leadership and cover, and the January 2014-April 2016 exigent surcharge that gave USPS $4.6 billion above inflation.

Postal management and labor fought long and hard to make the first emergency surcharge allowed under the 2006 postal law to be permanent. And they continue to lament how much better things would be if they had gotten their way. Maybe yes, maybe no, as no one knows for sure how large the impact on volume would be from unprecedented, sustained above-inflation postage rates.

During the same time period, a new labor contract went into effect for the largest postal union, effective July 8, 2016. If you are really interested, read pages 5-12 of the arbitration award, in which the lead arbitrator said he was ignoring the USPS financial condition and the compensation premium compared to the private sector here. Instead, the arbitrator chose to base the massive new contract on the much smaller agreement postal management negotiated with another union the year before.

The Postal Service is doing very well, but could do much more with productivity growth. To its credit, postal management seems to be bargaining more seriously now. The same union that won the arbitration award in 2016 recently disclosed the content of recent negotiations on a new contract:

“USPS economic proposals are nothing short of draconian and regressive. Their proposals include:

- No increase in pay rates – a freeze for current employees;

- One lump-sum payment in lieu of the usual annual pay raise;

- Lump-sum payments in lieu of COLAs.

- Decreasing the career workforce:

- Increasing the percentage of non-career employees to 25% in the clerk craft;

- Reintroduction of 10% PSEs into the maintenance workforce, undoing the all-career maintenance craft;

- Reintroduction of 10% PSEs into the MVS Craft.

- Pay and benefits substantially cut for all future conversion to career and future hires:

- A converted PSE would take a pay cut of almost $1.00 per hour and work into year three before getting back to the PSE rate.

- Current career employees with less than six years seniority must work 15 years to gain “no lay-off” protection.

- Elimination of no lay-off provision for all future workers.”

But it remains to be seen whether an independent arbitrator listens and reflects reality in the next award.

USPS Myth #3: The booming ecommerce-driven package sector cannot make up for the loss of mail volume.

The Postal Service has long said this, and emphasized that their package volume could go away quickly and unexpectedly. Rather than touting packages as a great opportunity, as they did when owning the last mile was the strategy, it seems that downplaying current and future success rules the day. The private sector—FedEx, UPS, Amazon, Target, Walmart, etc.—is touting both the current profitability and future opportunity from ecommerce delivery.

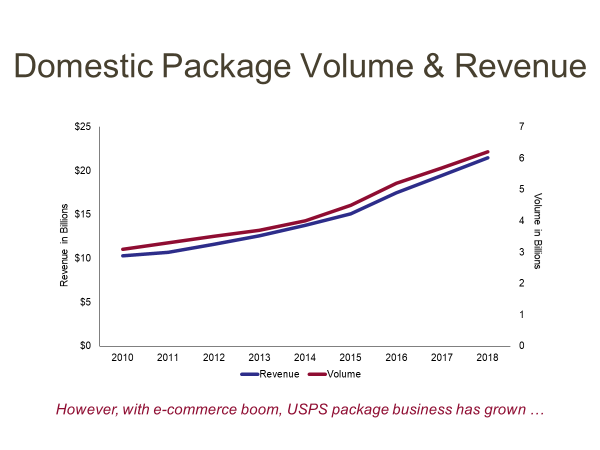

Actual USPS results point to increasing success and contribution from the competitive package sector. Volume and revenue are growing at a very healthy pace.

Sources: USPS 10-K Reports (about.usps.com)

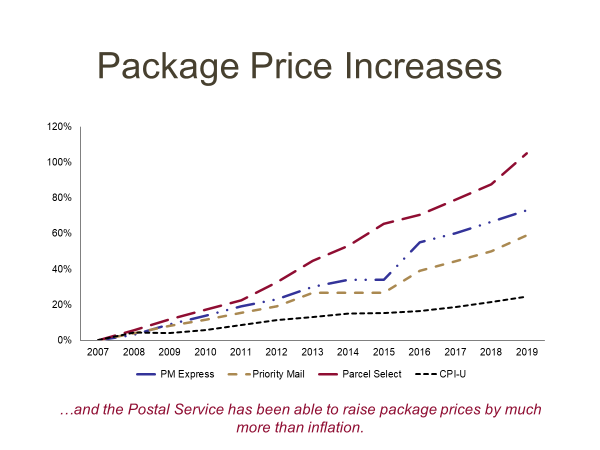

And the strength of the USPS market position is reflected in very strong pricing increases on the competitive side that has no price cap.

Sources: USPS Notices of Rate Adjustment/Competitive Products

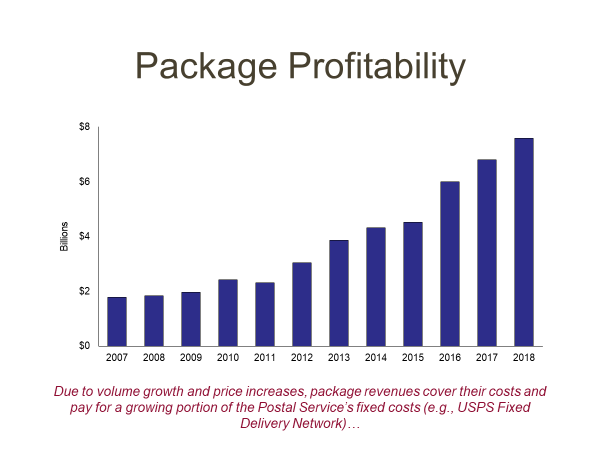

Package profitability is covering more and more of the cost of running the USPS network. Almost four times profit growth in the last several years is a reason for optimism.

Sources: USPS Annual Compliance Reports, USPS Public Cost and Revenue Analysis Reports (FY 2007 – FY 2016, FY 2018), PRC Docket No. ACR2017, PRC-LR-ACR2017-1

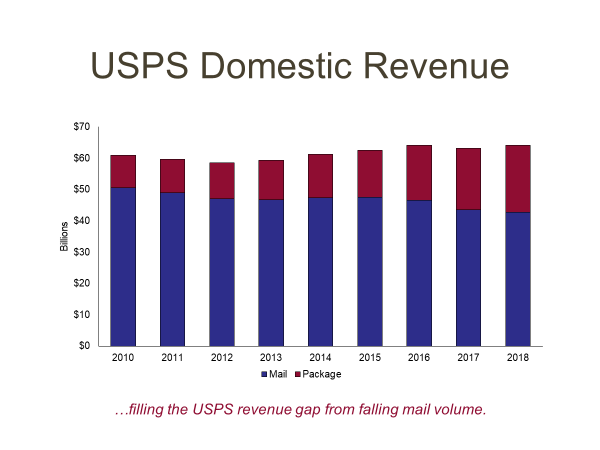

Packages have filled the revenue gap from the loss of mail volume in recent years.

Sources: USPS Annual Compliance Reports, USPS Public Cost and Revenue Analysis Reports (FY 2007 – FY 2016, FY 2018), PRC Docket No. ACR2017, PRC-LR-ACR2017-1

USPS Myth #4: Unfunded retiree obligations are a ticking time bomb.

No one argues that pre-funding promises made to employees that when they retire you will pay your share of the cost of their health insurance and pensions. Pre-funding refers to setting aside money to be invested and earmarked for future obligations. But repeatedly quoting the $60+ billion underfunded status of USPS retiree health benefits is not a reason to panic or declare a crisis. In fact, if you are really worried about the USPS pre-funding status, you should look elsewhere for much larger under-funded obligations.

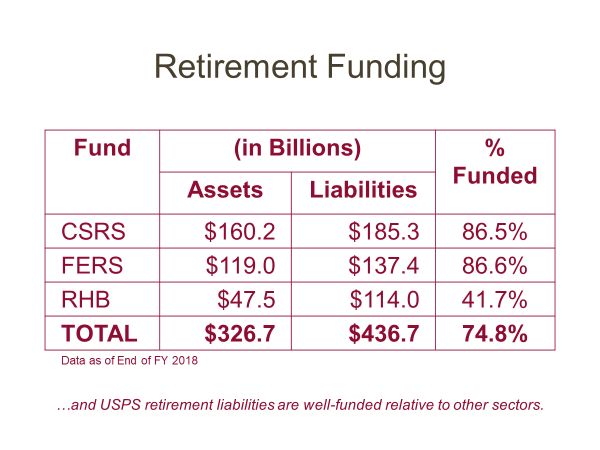

First, we should note that the Postal Service does have significant funds already set aside for retirees.

Source: USPS 10-K Report, FY 2018 (about.usps.com)

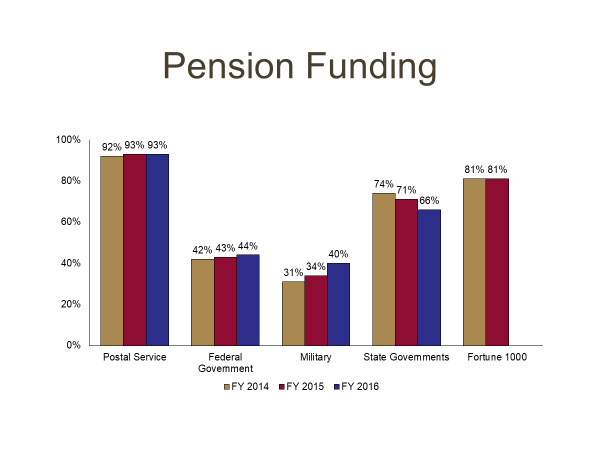

Second, the Postal Service is doing better with its pension plans than every other sector of our economy.

Source: Office of Inspector General, United States Postal Service, “Postal Service Retiree Funds Investment Strategies” (https://www.uspsoig.gov/sites/default/files/document-library-files/2017/FT-WP-17-001.pdf)

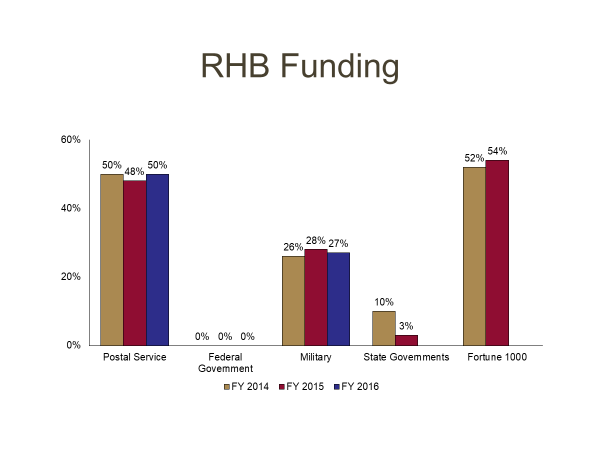

Third, USPS compares very well on retiree health care pre-funding. Note that the rest of the federal government has nothing set aside for health care pre-funding.

Source: Office of Inspector General, United States Postal Service, “Postal Service Retiree Funds Investment Strategies” (https://www.uspsoig.gov/sites/default/files/document-library-files/2017/FT-WP-17-001.pdf)

A final point is that the level of USPS pre-funding relative to obligations is vastly under-estimated for at least three reasons. First, the estimates do not include Medicare integration of postal retirees, as is common practice throughout the private sector. Many postal retirees use their federal health insurance as their primary plan rather than Medicare that they have been contributing to for years. Correcting this would reduce the obligation by close to the full under-funded amount.

Second, the USPS estimates are based on the full population of federal employees’ demographics. The Postal Service has demonstrated that using more accurate USPS demographics would reduce the estimates significantly.

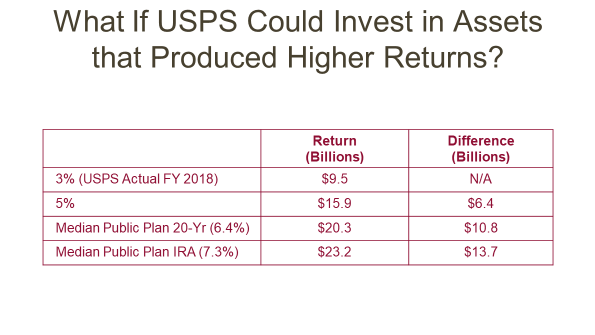

Finally, USPS pension and health funds are under-invested in non-marketable Treasury securities that return much less than typical public pension plans. Correcting this problem would push USPS into very profitable territory with as much as $13.7 billion more annual income.

Sources: USPS Actual of 3% from USPS FY 2018 10-K, pp. 33-34, 36; 5% is an assumption; Median Public Plan 20-Yr (6.4%) AND IRA (7.3%) from the National Association of State Retirement Administrators.

While fixing the pre-funding situation will require help from outside the agency, with the knowledge that it contains significant distortions and errors, we should not let it drive policy decisions that would hurt the core operations now.

Leave a Reply