June 14, 2017

Anyone worried about the prefunding of USPS retirement obligations should read our expert declaration by Michael Nadol filed in the PRC ten-year review. The Postal Service is very well funded compared to all other categories for both pensions and health care.

And this is using very conservative, some would say pessimistic, assumptions about key inputs to the likely future costs—government-wide demographics, low investment returns, high and growing healthcare costs, etc.

The USPS has over $338 billion already set aside and it is well ahead of mostly everyone else in reaching the ideal situation of 100 percent estimated prefunding.

Short-term panicky actions like major rate increases should not be employed to fix a very long-term goal to prefund all estimated obligations that we are well on the way to solving. This is especially true as USPS has reached a possible inflection point where it could go either way.

Our declaration contains much more detail. We are sharing some representative graphs here to illustrate the main point that USPS prefunding is in comparatively good shape.

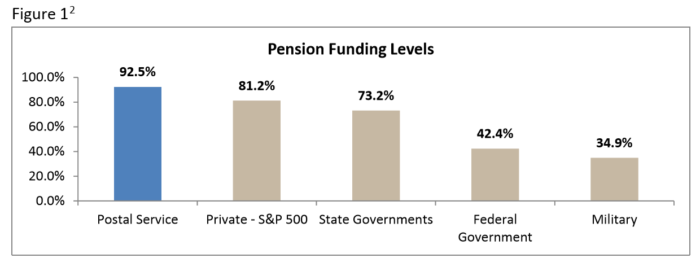

We can that Postal Service pension funding is better than the private sector, state governments, the federal government, and the military.

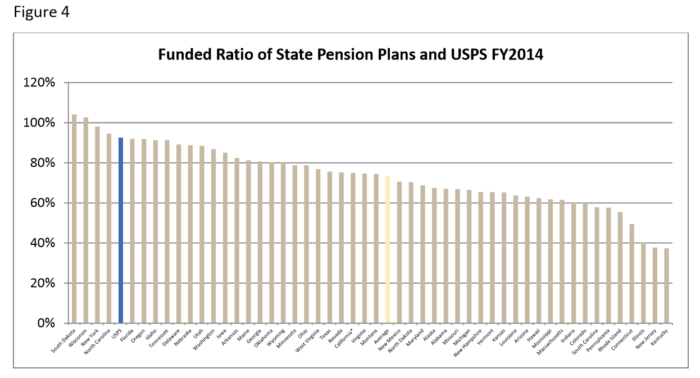

Here we learn that USPS pension prefunding is much better than the average state, and only four states are ahead of the Postal Service.

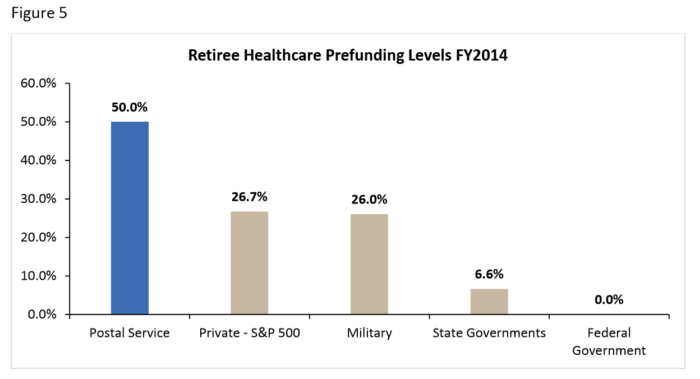

It is important to know that prefunding future estimated health care costs for retirees is only a recent phenomenon. And the USPS is way ahead of every other sector in achieving this goal, as we see below..

Leave a Reply