August 10, 2023

-

Rates

Today the Bureau of Labor Statistics released the Consumer Price Index for July. This is the fifth of six monthly CPI numbers that will determine the price cap for the expected January 2024 postal rate hikes. Through July 12, the Postal Regulatory Commission had the price cap pegged at 1.39%. With the addition of today’s and another on September 13, it now looks like the cap for January will be about 2%.

Keep in mind that January rate authority is based on only the CPI, while July hikes include the generous add-ons created by the PRC. Both semi-annual price increases do, however, require that marketing mail flats go up more than 2 percentage points above the cap.

While the January 2024 rate authority will be modest, the July 2024 cap will include an extra 4-4.5% add-on to reflect the very large decline in mail volume during FY 2023, plus another 1% to replenish postal retirement funds.

-

Consolidations

The centerpiece of the Delivering for America ten-year plan continues apace, albeit far from reaping any benefits for mailers. The consolidation and reconfiguration of the processing network is underway, but how long it will take to complete and when any benefits to customers will begin are unknown.

The plan is to move the final sortation of mail from local post offices to larger, more efficient facilities that handle both mail and packages. The Postal Service says that there will be 60 to 65 Regional Processing & Delivery Centers (RPDCs) and 180 to 200 Local Processing Centers (LPCs). This is the master plan of Postmaster General Louis DeJoy who says the necessity for the changes is obvious to him and anyone who understands logistics.

The PRC has started a not-so-public inquiry to try to unearth more useful information about the grand scheme for the USPS network. It is less than public because much of the requested information, such as details on projected cost savings, is being either withheld or filed under seal at the regulator. The inquiry can be found on the PRC.gov website under docket PI2023-4.

One mailer association, PostCom, filed for access to documents provided by USPS under seal, and its three attorneys and president were granted said access but under strict rules not to share the information with others.

The best source of information about the USPS consolidations continues to be the website www.savethepostoffice.com.

Opposition to the massive consolidation plan has started to emerge from postal union members and Congressional representatives. Several consolidation plans by previous postmasters general were thwarted by the same type of Congressional/union opposition. The main concerns include the potential closure of post offices that no longer have carriers picking up mail for delivery, forced relocation of employees, and the need for employees to commute farther than their current local post office.

In his remarks to the USPS Board of Governors in its public meeting yesterday, PMG DeJoy expressed confidence that he will overcome obstacles that doomed previous attempts at consolidation: “Our management team is working harder and smarter, our employees are engaged and participating in the changes, our customers are interested in our new products and initiatives, and together we are navigating the distractions of those who so ably derailed any initiatives of the organization in the past.”

Mr. DeJoy has repeatedly drawn a direct line between his remake of the postal network and the need to keep raising prices for market-dominant mail using the full rate authority granted by the PRC every six months. In his board remarks yesterday, DeJoy reiterated one of his favorite mantras: “…we must continue our strategy to leverage our market-dominant pricing authority to mitigate the impact of inflation and our requirement to serve expanding delivery points.” He said this despite his chief financial officer’s report that USPS had a near-record $21 billion in excess cash as of June 30. The agency’s 10-Q stated: “Our average daily liquidity balance was $22.6 billion and $26.1 billion for the nine months ended June 30, 2023 and 2022, respectively.”

The main problem with the over-reliance on rate hikes for captive monopoly mail customers is that it is driving an excessive amount of volume from the USPS system, 8.1 billion pieces or 8.3% thus far this fiscal year. USPS has long benefited from economies of scale to be the most efficient, cost-effective post in the world.

-

Finances

Yesterday, the Postal Service released its 10-Q financial report for the third quarter (April-June) of fiscal year 2023. Three years into Louis DeJoy’s tenure as Postmaster General and two years after his release of the Delivering for America ten-year plan, USPS finances are getting worse rather than improving.

PMG DeJoy’s financial record is not what he hoped to achieve:

Year Total Volume (billions) Operating Loss (billions)

FY 2020 129.2 -13.4 -9.4% ($9.176)

FY 2021 128.9 -0.3 -0.2% ($4.830)

FY 2022 127.3 -1.6 -1.2% ($0.950) before $56.975 from Congress

FY2023/Q3 89.2 -8.1 -8.3% ($5.630)

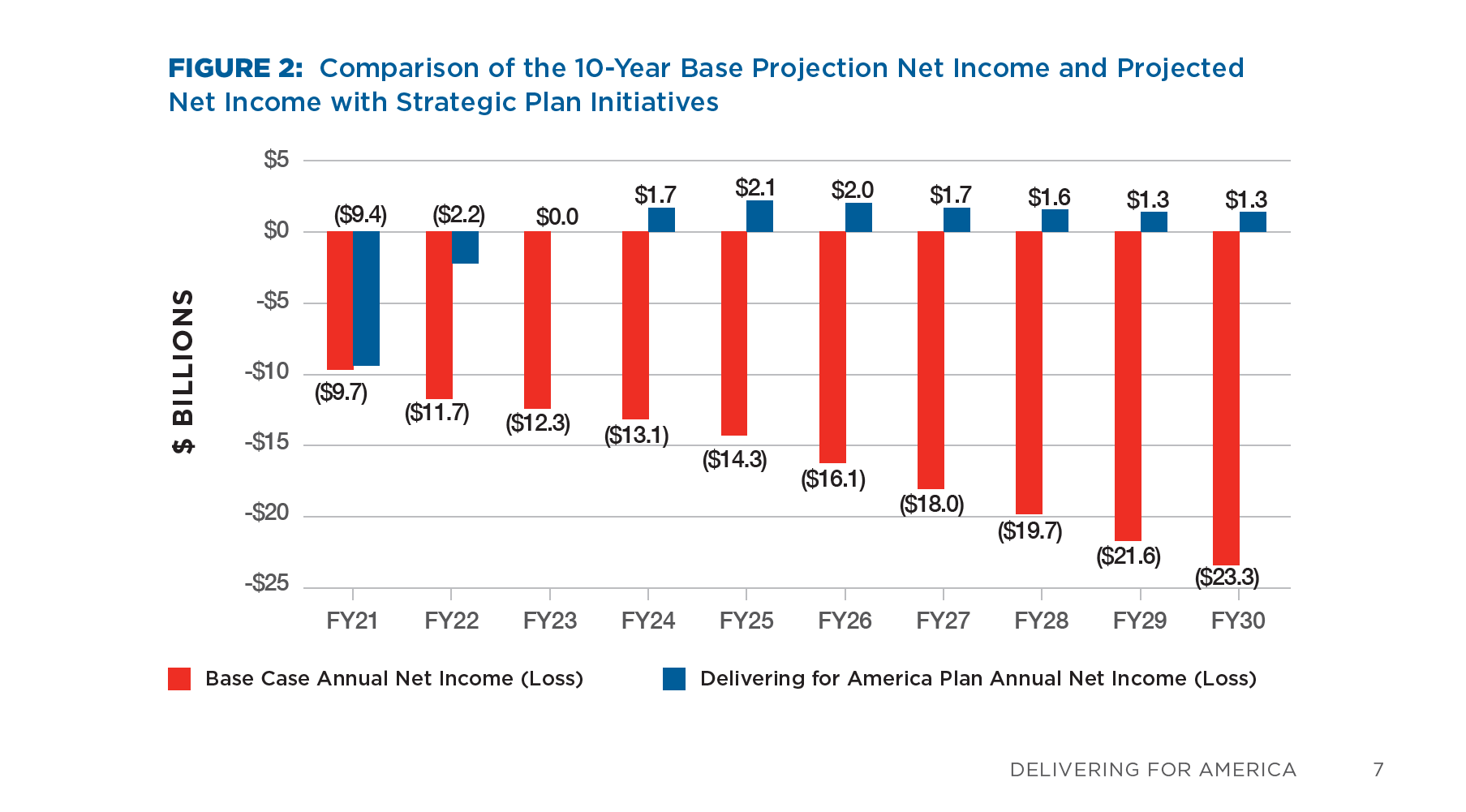

Delivering for America two years ago promised financial success this year: that the agency would reach financial breakeven in FY 2023. Instead, USPS has lost $5.6 billion three-quarters of the way into the year. This compares to the annual plan filed near the beginning of the fiscal year to lose $4.5 billion for all of FY 2023. The final loss for the year is likely to be $6 billion or more.

The impact of record rate increases for monopoly mail is obvious and striking. Never before has the agency implemented a rate hike, as it did in July 2022 and January 2023, and seen its volume and revenue drop in tandem. Usually, there has been a small drop in volume and a significant increase in revenue.

Nine months into FY 2023, USPS already has lost 8.1 billion pieces of mail compared to the prior year’s three quarters. Operating revenue through the third quarter is down $446 million or 0.7%. Year-to-date USPS total revenue is down $353 million or 0.6%. Further exacerbating bottom-line losses, operating expenses are up by $5.878 billion or 9.9% compared to the same period last year.

Yesterday’s report included details on the most recent quarter:

Third Quarter Results

- In the third quarter, USPS lost $1.736 billion.

- The quarter’s revenue was down by $168 million 0r 0.9% compared to the previous year’s Q3.

- First-Class Mail volume dropped by 678 million pieces or 5.9%, and with substantial rate hikes, revenue gained $221 million or 4.0 percent.

- Marketing Mail volume plummeted by 2.58 billion pieces or 16%, and revenue decreased by $333 million, or 8.8%.

- Periodicals lost 142 million pieces or 15.6%, and revenue was down 5.7%.

- Competitive Packages shrunk by 41 million pieces or 2.4%, causing revenue to drop .04%.

- Total operating expenses were $20.5 billion for the quarter, an increase of $1.8 billion, or 9.6%.

This report marks the last period before the July 9, 2023 rate hikes. Excessive price increases already implemented bi-annually are taking a toll on USPS mail volumes.

It also precedes the rebranding of USPS competitive package services as “Ground Advantage.” The agency is placing a large bet on this simplified, lower prices package offering. It hopes to become the preferred package provider to many customers in a very competitive field. The July 10th rollout of GA included this statement:

“USPS Ground Advantage is a game changer – for our customers, the industry and USPS. By efficiently and effectively integrating our ground transportation model to the magnificence of our last mile delivery operations, we can now offer the most compelling ground shipping offering in the market,” said Louis DeJoy, United States Postmaster General and CEO. “With USPS Ground Advantage, we are ready to compete for an increased share of the growing package business.”

The Postal Service does not need the recent excessive rate hikes on market-dominant mail as the agency reported that it holds more than enough cash and borrowing capacity. Regulatory rate authority can be “banked” for later use when the cash is needed and inflation has subsided. USPS is getting no revenue growth from the rate increases.

Leave a Reply