February 2, 2023

Bad news and good news

First, the bad news. At the Mailers Technical Advisory Committee meeting this week, USPS VP for pricing and costing gave the agency’s first estimate of the rate increase authority it expects to have, and most likely fully use, in July 2023.

Sharon Owens forecast the general July rate authority for compensatory products and classes at 5.3%, assuming 3.3% CPI authority. This includes the extra 1% USPS wants to add, based on the “mail density” formula assuming the $57 billion in Congressional savings are ignored in the calculation. The Alliance and other mailers are opposing this accounting sleight of hand at the Postal Regulatory Commission, and if we win, the cap would go down to 4.3%.

Using the 5.3% baseline, non-compensatory products like Marketing Mail flats would go up at least 7.3%, and very likely much more as USPS claims they cover only 45% of their attributable costs. The flats increases would be balanced by lower increases on compensatory Marketing Mail products like letters. As a reminder, USPS already has raised rates on nonprofit Marketing Mail flats by about 40% over the past two years.

Again, using the 5.3% baseline, Ms. Owens predicted that the Periodicals class, which is non-compensatory, would go up an average of 8.1% in July. This includes the PRC-required and USPS-embraced extra 2%, plus another 0.744% in “banked” authority previously not used by USPS. If we mailers win the case at the PRC, then Periodicals would be capped at 7.1%.

Postmaster General Louis DeJoy reiterated in his remarks at MTAC that he has no plans to moderate USPS rate hikes by either using less than full authority or returning to annual, rather than twice-yearly, increases. When pressed, he did allow that annual hikes might return when inflation cools to more sustainable, normal levels.

The USPS forecasts fall within the middle of the ranges we previously provided our members as a rough estimate:

- Compensatory: 4.2% – 7.4%

- Non-Compensatory: 6.2% – 9.4%

Our ranges included both the uncertainty about inflation and the +/- possibility regarding the density add-on.

Now, the good news. The January 2024 rate increase authority, which is based only on six months of Consumer Price Index inflation, is likely to be less than 2%, maybe even less than 1%. We reach this rough estimate by forecasting CPI based on a range of potential month-to-month CPI increases (from 0% to 0.4%) and plugging the forecasted CPI figures into the PRC formula.

Non-compensatory products like NPMM flats would be subject to at least an extra 2%, balanced by lower increases on compensatory Marketing Mail products like letters.

There will be no other add-ons to CPI in January, whether for density or retirement obligations or on non-compensatory classes like Periodicals.

In less than a year, USPS will be faced with intense pressure to return to annual rate hikes, as the allowable January 2024 increase will be tiny. Further, if the Federal Reserve is successful in returning inflation to its target of 2% for the longer term, the Postal Service annual rate authority likely will be in the range of 3-4% until the end of the five-year PRC experiment returns the cap to about 2%.

Postmaster General DeJoy has grievances

In the course of his unscripted hour-long remarks to MTAC this week, Postmaster General continued the praise of his tenure at USPS, especially in contrast to the disastrous terms of his predecessors. And while he always has had much to criticize, his list of grievances seemed to expand this week. Complaints included:

- Mailers opposing USPS in the PRC filings about their desire to ignore the $57 billion in Congressional savings for retiree health benefits. He said we shouldn’t be doing this and he can’t succeed if we keep doing things like this.

- The regulatory process USPS has to go through. One example he gave was how long it has taken to change the package service products. He said he really would like to get rid of the PRC.

- The procurement process at USPS. He talked about how his private business had USPS contracts and eventually, he stopped being directly involved because the process was so convoluted.

- Having to satisfy a board made up of people with their own opinions.

- News stories, and those who share them, about poor postal delivery service around the nation. He said their data proves that these are outliers.

- Reports that he “caved” on the decision to go with an electric fleet.

Being a Postmaster General in the 21st century has got to be one of the toughest, most thankless jobs anywhere. Mr. DeJoy is well aware that he can’t move the needle as far or as quickly as he did in private business, and that he doesn’t have as clear metrics as the private sector by which to measure success.

The major successes of the past three years have been in areas that are important but have not trickled down to the everyday mailers that provide the vast majority of funding for the agency. Public relations have touted successful voting by mail for two election cycles, delivery of free Covid test kits for the government, taking the lead in President Biden’s push to get the federal government to reduce emissions, and aggregate measures of mail delivery times that do not necessarily reflect individual mailers’ experiences.

Mr. DeJoy’s fourth year in office starts this June, and he has declared this to be a year of “implementation.” He is referring primarily to logistical improvements in the USPS delivery network that move the final step in mail sorting to larger facilities and away from local post offices.

There is much hope in the mailing industry that efficiencies will result from these and other improvements. By how much and when are still very uncertain. Further, there is no assurance about the degree to which efficiencies and cost savings will be shared with the mailers that fund the agency.

The clock is ticking, however, as allowable rate increases on monopoly mail are set to moderate substantially in less than a year. Already, the Delivering for America plan is way behind its promise to break even by this year, Fiscal Year 2023.

Next week, USPS will release its financial results for its first fiscal quarter, October-December 2022. Already October and November are showing significant declines in both mail and package volume, as we previously reported. And the Postal Service itself reported an 11% decline in volume during this year’s peak holiday season compared to last year.

USPS doesn’t need the cash from excessive rate hikes

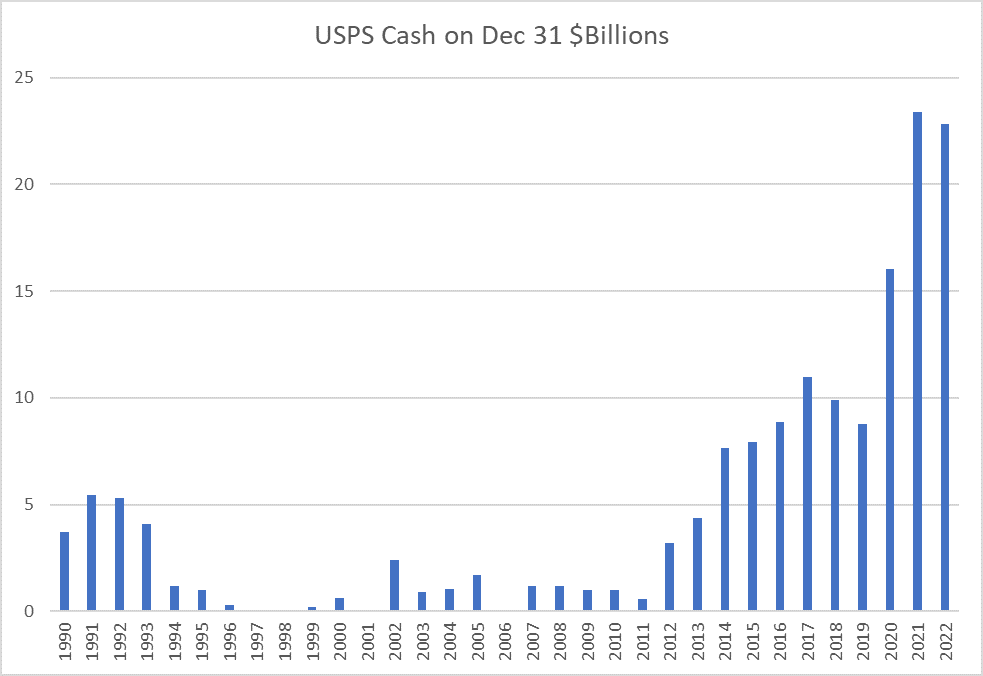

USPS had operating cash of $22.8 billion on December 31, 2022, under-invested in short-term Treasury securities. USPS doesn’t need all of that idle cash. The agency does not need to raise rates on mailers twice a year. It does not need to use the full rate increase authority granted by the Postal Regulatory Commission.

Rate authority can be “banked” for use in later years when inflation moves below 40-year highs. USPS is needlessly chasing away mailers and mail volume with unnecessary punitive rate hikes. The USPS OIG recently confirmed that USPS is leaving money on the table by holding so much cash in low-interest investments. More importantly, the mail agency is losing its customer base by raising rates more than necessary.

In the 1990s and early 2000s, when mail volume was growing and USPS was operating profitably, the agency employed efficient cash management, carrying much lower balances than today.

Leave a Reply