May 2, 2024

Issue 24/06

The leading voice for nonprofits on postal issues for over 44 years.

Copyright 2024 Alliance of Nonprofit Mailers—All rights reserved.

A 501 (c)(4) nonprofit organization established by nonprofits for nonprofits.

DeJoy is taking the heat for trying to perform a miracle, and he wants everyone to have faith in him!

Postmaster General Louis DeJoy is trying to perform a miracle. He is endeavoring to make the United States Postal Service work within a possibly unworkable legislative, labor relations, and regulatory framework.

DeJoy is taking the legislation created in 1970 and enhanced in 2006 to run the USPS as a self-funded businesslike organization to its logical conclusion. And it’s not a pretty sight.

Never before has a PMG been so determined to make the postal model work in the face of overwhelming headwinds. He is confident that he knows how to do it and that he is uniquely qualified to lead USPS out of the mess it’s in.

Headwinds

The barriers to making this model work are many and formidable:

1.Mail volume has dropped from a high of 213 billion in FY 2006 to 116 billion in FY 2023, including packages. That’s a decline of 97 billion pieces or 46% in 17 years. First-Class Mail volume peaked earlier in FY 2001 at 104 billion and was down to 46 billion in FY 2023, a drop of 58 billion or 56%. FCM is the most profitable USPS product and the one on and for which the current network was built.

2. USPS is required by law to perform all sorts of very important public services that no competitive business would attempt or be able to afford and sustain.

-These include delivering to almost all delivery points in the USA. There were 166.6 million delivery points in FY 2023, versus 146.2 million in FY 2006 when volume peaked.

-The Postal Service must by law deliver to virtually every address six days a week, even though many Americans do not want or need such service. If they had to pay directly for it many surely would decline.

-USPS must also operate about 30,000 post offices, even though about 42% do not cover their costs.

-USPS must offer preferred pricing to certain categories of mailing customers, including nonprofits, according to formulae mandated by Congress.

3. About 70% of USPS costs are labor and most employees are members of powerful public unions. Postal union career employees have guaranteed employment, excellent pay, automatic inflation escalators, automatic raises, a combination of defined-benefit and defined-contribution pensions, no-layoff clauses, top-notch health insurance guaranteed for life, and unions that are very active in filing grievances. With no right to strike, if unions and management cannot negotiate a contract, it is decided by a panel of arbitrators that issues binding orders that usually split the difference. Under the current USPS leadership, many temporary employees have been converted to full-fledged career workers despite the decline in volumes.

4. Politicians who normally have no interest in or knowledge of USPS issues will jump in when their constituents, whether employees or customers have a problem with the Postal Service. These same politicians seem unwilling to take on the real long-term issues that must be addressed to have a functioning public postal system. This was very clearly demonstrated in the April 16 Senate hearing.

Current Efforts

The Postal Service is currently emphasizing three main initiatives to try to rescue the agency:

1. Remake the processing and distribution network to be a more modern, efficient, and better workplace. In the process, the goal is to create more of an integrated network that processes both packages and mail. An underlying goal is to emphasize packages more than mail. The USPS is starting to open the first few of what will eventually be about 60 Regional Processing and Distribution Centers. Mail that previously was processed for final delivery at local post offices will be handled centrally at RPDCs. Carriers will have to drive much farther to their routes, necessitating more routes with less time to deliver mail.

2. Raise rates on Market Dominant Mail using all the extra rate authority the PRC gave USPS shortly before DeJoy was appointed. The extra authority has been exacerbated by 40-year highs in inflation and the unilateral decision by USPS to raise rates twice a year. The rate increases have been enhanced by prior year declines in mail volume that give USPS more authority the following year. The idea seems to be to grab as much cash as possible as quickly as possible to finance the $40 billion overhaul of the postal network.

3. Greatly increase the USPS market share of the package delivery market to add a very large amount of revenue and contribution to offset the expected loss of letters and flat mail. The new USPS Ground Advantage service has been the backbone of the new package strategy while Priority Mail and contracts to drop ship packages to destination delivery units are being de-emphasized.

How’s it going?

1. The opening of the new network in the form of regional processing and Distribution Centers has been a complete flop so far. The Richmond, VA, and Houston, TX areas have experienced terrible service with the new configuration. The Inspector General’s audit cataloged a long list of implementation and planning failures by USPS. Virginia and Texas are cases of using preexisting facilities, so the Postal Service pointed to legacy issues as reasons for its failure. On the other hand, the Atlanta GA redo was a completely new facility for the RPDC. As SavethePostOffice.com said under the headline Atlanta RPDC Crashes on Launch: “Outside forces may have contributed to delays in Virginia and Texas and elsewhere in the country, but what’s happened in Georgia is due almost entirely to the actions of the Postal Service. The Postmaster General and his leadership team — several of whom come from his former company, XPO Logistics — have nobody to blame but themselves. The buck stops with them.” At the Senate hearing, DeJoy blamed the failures on flawed execution tied to the old USPS culture. He said we should see improvements by summer. Senators made it clear that he needs to get Atlanta and Richmond right if he wants to go further.

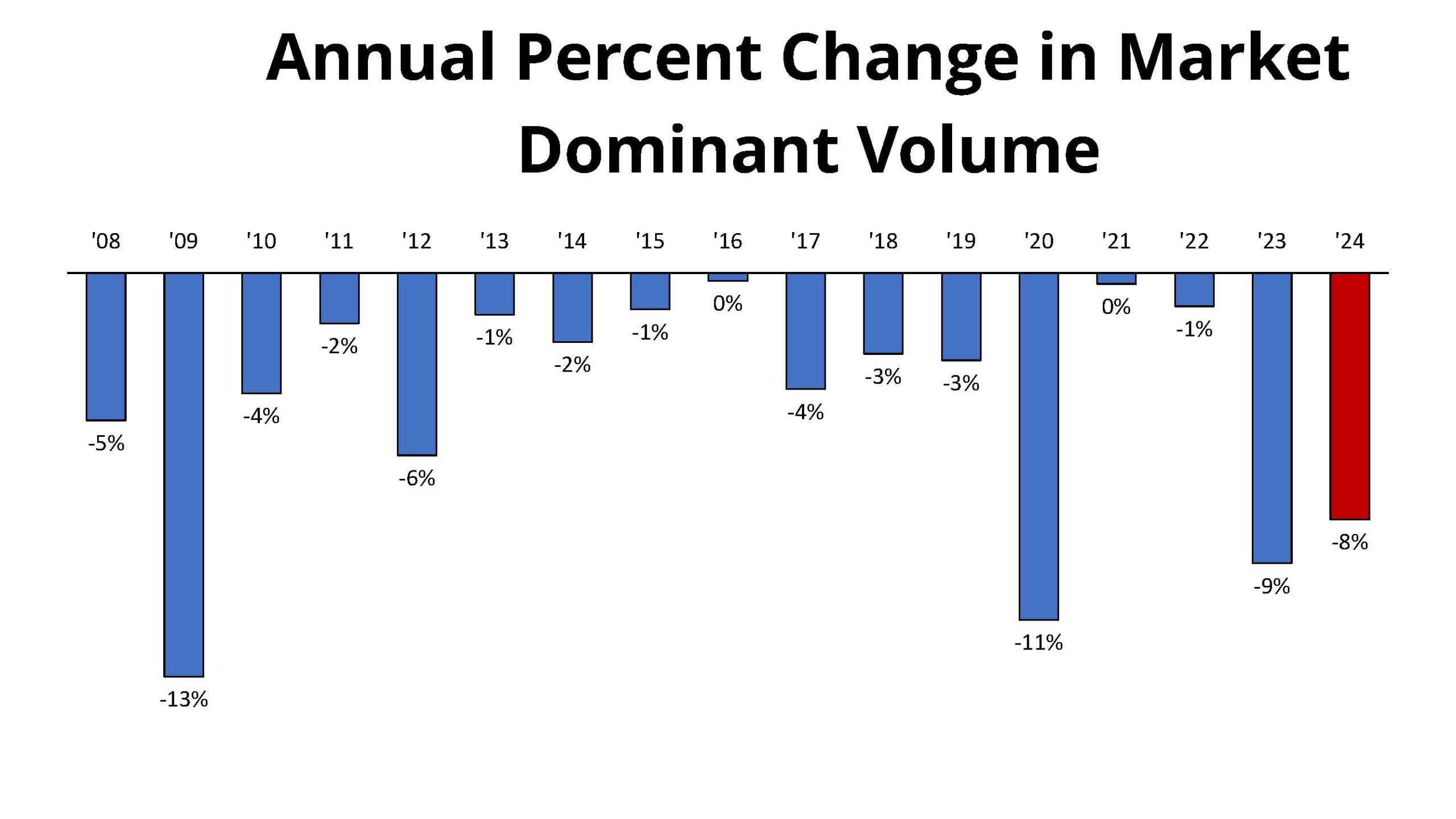

2. The massive Market Dominant rate increases have yielded very weak results for USPS. Mail volume dropped 9% in FY 2023 and is projected by USPS to fall 8% in FY 2024. These declines are much more than the recent annual average of 2.4% when you exclude the only two larger drops caused by external crises—the Great Recession and the COVID-19 pandemic.

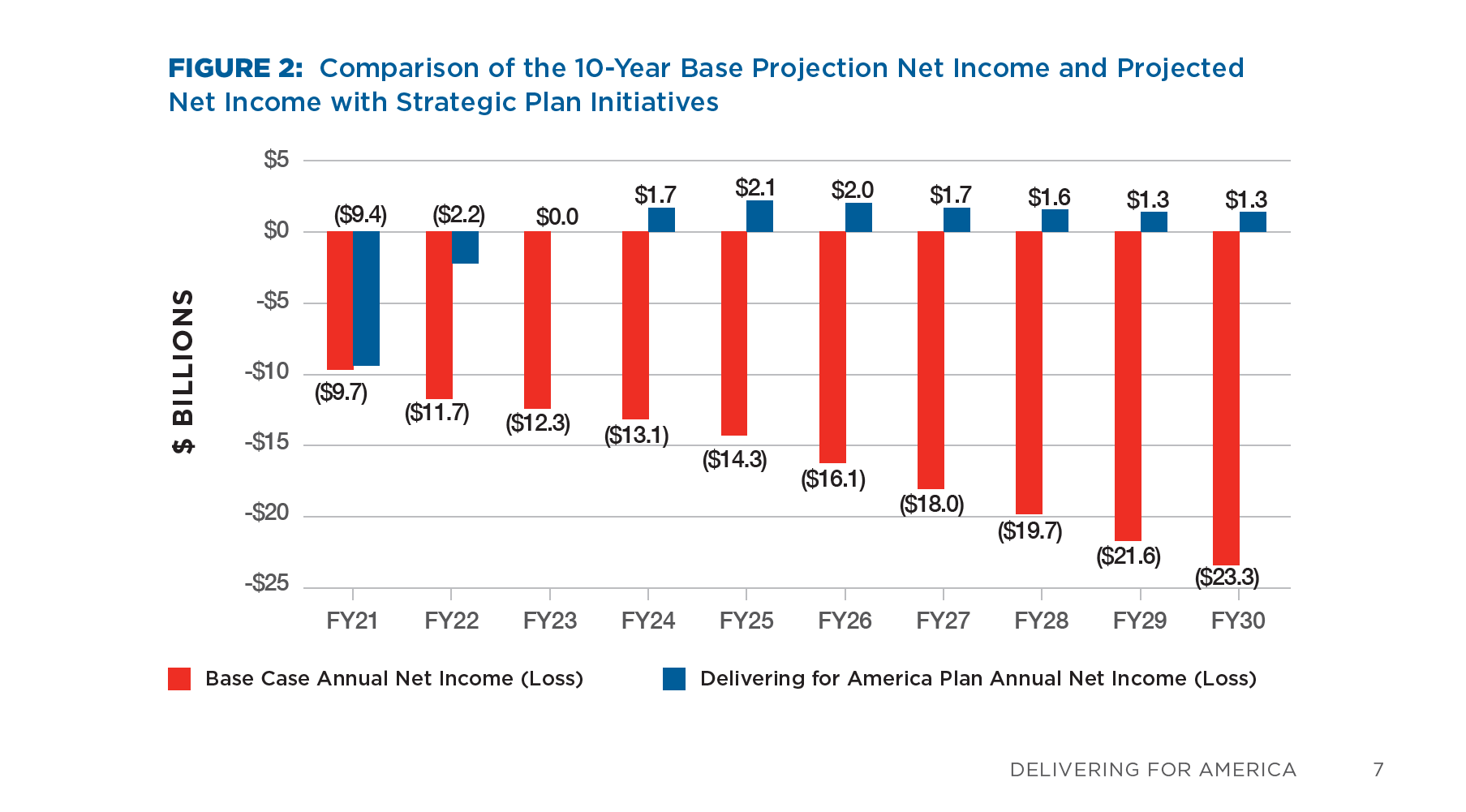

The Delivering for America plan predicted breakeven in FY 2023 and profits thereafter; USPS lost $6.5 billion last year. The official USPS plan for FY 2024 calls for a loss of $6.3 billion. Results so far indicate that the plan for this year could be overly optimistic.

The excessive pricing has not yielded the revenue growth USPS sought. Total operating revenue was $78.2 billion in FY 2023, a decrease of $321 million, or 0.4 percent, compared to last year, as package revenue increases were offset by mail revenue declines. Mail revenue was down by 1.4% despite record rate increases twice during the year. Package revenue grew only 1.0%.

Total operating expenses were $85.4 billion in FY 2023, an increase of $5.8 billion, or 7.3 percent. On a non-GAAP basis, adjusted operating expenses increased by $2.1 billion, or 2.6 percent. In any case, expenses continue to outpace revenues which has been the story for some time. But now USPS is raising prices well above inflation, twice a year, and still not improving the finances.

Two important related actions were: (1) a mailer-funded study showed the defects in the USPS price elasticity model that led the agency to expect that large, more frequent price increases would cause only small volume declines and yield large revenue increases, and (2) the PRC announced that it would start a new review of the rate regulations two years earlier than the promised five-year review. Perhaps expecting to lose rate authority, USPS continued to use full rate authority for the July hikes, ignoring the flaws in its modeling.

3. Growth of package shipping did not happen in FY 2023. Revenue for the overall Shipping and Packages category increased $324 million, or 1.0%, on a volume decline of 175 million pieces, or 2.4%. In July 2023, the Postal Service introduced USPS Ground Advantage, a new shipping offering that is intended to be a simple, reliable, and more affordable way to ship packages and therefore lead to growth.

In the first five months of FY 2024, modest package growth is happening, but not enough to change the outlook for a loss exceeding $6 billion. Through February, package volume was up by 16 million, or 3.3%, while revenue increased by $149 million, or 5.3%.

Revenue in 2024 is projected by USPS to increase by $2.4 billion (3.0%) compared to 2023. The Postal Service expects $2.1 billion of the $2.4 billion is expected to come from the hotly contested package market. And that is just to make the projected $6.3 billion overall loss. And through the first five months, packages have grown by only $149 million.

At the Senate hearing on April 16, Postmaster General DeJoy said that he envisions $3 billion in package revenue growth over an unspecified period. But with annual losses exceeding $6 billion, he needs more like $3 billion in package contribution, or profit, growth. That’s more like $6 billion in revenue growth.

Conclusion

So far, the Delivering for America plan is an article of faith rather than a provable plan. To believe in the eventual success of the USPS plan, one must now take it on faith because there is no evidence that it is working or is going to succeed, three years in.

Part of the reason the plan is based on faith is that the Postal Service has not been forthcoming with data and evidence that demonstrates a pathway to the success it predicts. That is what the PRC, OIG, and members of Congress are focused on.

Perhaps a more important reason that the plan shows little evidence it can succeed is the Congressionally-mandated business model running into the headwinds this report started with. With those limitations, the hope to run the agency as a self-funding businesslike entity might just be a pipe dream.

The choice that no one at USPS will contemplate, and no politicians want to take on, is to move the agency substantially either in the direction of privatization or back to the hybrid funding model under which it operated for two centuries.

Nonprofits can mail coffee mugs again!

The Alliance recently advocated for nonprofit mailers, outside the confines of a formal PRC docket, on an issue relating to the maximum size requirements for USPS Marketing Mail parcels that many nonprofits use. The Alliance’s efforts were supported by the valuable assistance and institutional knowledge of Scott Hochberg, CEO of Postage Saver Software.

Last fall, USPS changed the rules for nonprofit parcel postage rates to severely limit the size of each parcel and to require a phrase like “or current resident” to be included in the addresses.

As a result of that change, items thicker than 2″ could no longer be sent at nonprofit rates. So, t-shirts and tote bags were still OK, but coffee mugs were out.

As background, since 2012 USPS Marketing Mail parcels have been subdivided into categories: (1) Marketing Mail Marketing Parcels were typically used for small, lightweight, and thin mailable items such as flyers and catalogs, with maximum dimensions of 12 inches in length, 9 inches in height, and only 2 inches in thickness. These were available to both commercial and nonprofit mailers, with nonprofit rates being set at a discount; and (2) Marketing Mail Nonprofit Machinable Parcels and Nonprofit Irregular Parcels were utilized by nonprofit mailers for larger items, as the dimensions for both sub-products could be up to 108 inches in combined length and girth.

As part of the Postal Service price changes that became effective on July 9, 2023, the USPS revised the requirement for machinable parcels’ maximum dimensions. In the July 27, 2023, Postal Bulletin, the Postal Service “clarif[ied] that the revised requirement for maximum machinable parcel dimensions does not affect USPS Marketing Mail parcels” and that “USPS Marketing Mail parcel categories must not exceed 12 inches long, 9 inches wide, and 2 inches thick.”

USPS announced recently that it has changed the rule back to what it used to be. “Marketing Mail Nonprofit Parcels” can again be up to 108″ in length plus girth, and do not require the use of “or current resident”.

The Postal Service fixed its error in the April 18, 2024 issue of the Postal Bulletin (see pp. 36-37). It stated:

Currently, the criteria in section 201.8.4.2 provides required dimensions and characteristics for USPS Marketing Mail parcels. The criteria does not clearly address the required dimensions and characteristics each for specific types of USPS Marketing Mail parcels, including Marketing parcels (regular and nonprofit), Nonprofit machinable parcels, and Nonprofit irregular parcels. The Postal Service is revising the criteria in section 201.8.4.2 to clearly list the required dimensions and characteristics each for Marketing parcels, Nonprofit machinable parcels, and Nonprofit irregular parcels.

If nonprofit mailers who were eligible for Nonprofit Machinable or Irregular Parcel rates were charged higher rates by USPS due to this error, they may consider seeking a refund no later than 60 days from the mailing date under the rules found at DMM 604.9.

Leave a Reply