Postal updates: The more things change…the more they stay the same

Losses

Despite the grand promises made by Postmaster General Louis DeJoy and his Delivering for America (DFA) plan, longtime observers of the Postal Service see common themes repeating themselves.

USPS just reported results for the Fiscal Year 2022 ending September 30. The agency lost almost $500 million (adjusted) despite record rate hikes that increased operating revenue by $1.5 billion or 1.9%. Operating costs still exceed and grow faster than rapid revenue growth.

The $57 billion retiree health benefit pre-funding relief provided by the Postal Service Reform Act of 2022 was excluded from the adjusted results and generally downplayed by USPS officials.

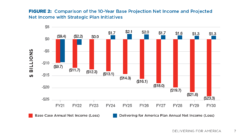

Planned losses

Worse still, the agency’s board approved a plan for Fy 2023 that targets a much larger loss approaching $4 billion. The plan assumes a continuation of record rate increases twice a year for Market Dominant mail.

PMG DeJoy admitted that USPS will badly miss its DFA goal of breaking even by FY 2023. Further, he said that mailers will have to wait at least five years to benefit from his improvements with a return to normalcy with rates. (Click to enlarge.)

We will fix things in the long-run

Five years is the optimistic scenario if all stakeholders fully cooperate with his plan. As the PMG stated, “As I have said before, this means change — a lot of it — and it takes time. With stakeholder cooperation, this will take five years to mostly accomplish. Without stakeholder cooperation, a lot longer.”

Packages not delivering, Marketing Mail the one bright spot

The renaissance of the USPS package side is supposed to lift all boats in the DFA plan. But that did not happen in FY 2022. USPS experienced a $700 million, or 2.2%, decrease in package revenue and a 399 million pieces, or 5.3%, decline in volume from FY 2021 to 2022.

Marketing Mail revenue in Fy 2022 increased by $1.4 billion, or 9.7%, compared to the prior year, with volume growth of 894 million pieces, or 1.4%. The large gap between revenue and volume growth, of course, is indicative of very large rate hikes.

First-Class Mail revenue increased by $772 million, or 3.3%, despite a volume decline of 1.7 billion pieces, or 3.4%. USPS attributed all of the First-Class volume decline to factors outside of its control.

Service inconsistent

Mail delivery service did improve in FY 2022, albeit with slower service standards for First-Class Mail. The agency said it delivered 93.11% of all First-Class Mail on time in FY 2022, a 4.6% improvement over the prior year. That level of service exceeds the 91% service performance target set for the year but falls short of the longer-term goal of 95% or better. On average, it took 2.4 days for USPS to deliver First-Class Mail.

Consistent mail delivery service could help USPS retain and possibly grow First-Class Mail. Mail service providers and mailers are seeing lower service performance in recent weeks. For example, SnailWorks reports First-Class at 85.7% on time in the first half of November, with an average delivery time of 3.39 days.

Several nonprofits that use Business Reply Mail (BRM) are reporting very inconsistent service on the receiving end of this important revenue stream. We hear many stories about BRM not being available for days at the receiving Post Office used by the mailer. The most frequent explanation we hear is understaffing at the Post Offices. If a BRM clerk calls in sick or takes vacation time, there is no one to cover their duties.

BRM is part of the most profitable USPS product, First-Class mail, that the agency says it cannot influence. Prioritizing the handling and processing of BRM nationwide is one example of concrete action USPS could take to stabilize First-Class Mail. Thus far, USPS managers seem to be limited to a “whack-a-mole” response to each report of delayed BRM.

Silos

At the recent meeting of the Mailers Technical Advisory Committee, the heads of the three operational silos presented—logistics, processing, and delivery. All had complex, grand plans to make things better. They did not talk much about how their plans are integrated with each other and with customers. Given the immense size of USPS, it is almost inevitable that management will operate in silos.

An audience member told the logistics head that over three-quarters of all Marketing and Periodicals Mail is drop-shipped into the USPS system by third-party providers hired by mailers. The MTAC member suggested that the new, improved software that USPS logistics is using to work better with its contractors also be integrated with the mailers’ providers. The head of logistics indicated that he will look into that, seeming to be previously unaware of the large role of private-sector drop-shipping.

Board chairman and vice chairman re-elected

Trump appointee Roman Martinez was re-elected by the Governors as the chairman and Biden appointee Anton Hajjar was re-elected as vice chairman at the November 10 meeting.

USPS sacking sacks

The period for comments on the USPS plan to eliminate most sacks from its system is November 21. The agency describes the removal of sacks as follows:

As part of its network redesign efforts, the Postal Service is proposing to eliminate the use of sacks as containers for Flats acceptance/entry but will continue to allow Flat trays as acceptable containers for acceptance and entry along with bundles on pallets for USPS Marketing Mail and Periodicals Flat Mail. The exception to this proposal is that carrier route, 5-digit scheme carrier routes and 5-digit carrier routes flat mail will continue to be allowed to use sacks as a handling unit.

USPS supports PRC approval to operate outside the rules

To no one’s surprise, the Postal Service objected to the Alliance’s joint letter to the PRC opposing its acceptance of USPS plans to operate outside the rules in how it portrays the financial benefits of the Postal Reform Act of 2022 in its Annual Compliance Report. USPS brushed over the fact that its accounting sleight of hand would enable the agency to levy over $400 million in additional, unjustified rate increases on mailers next year. Expect a response from your Alliance and other mailers.

Separate reporting of nonprofit mail service moves forward

As we previously reported, the Postal Regulatory Commission formally proposed rules to implement most of the Alliance’s suggestions regarding the separate reporting of mail service performance for nonprofit Marketing and Periodicals Mail. We filed comments supporting the components of the PRC proposal that we had suggested, and recommending enhancements to give mailers, the USPS, the PRC, and other interested parties a full picture of nonprofit use of Marketing, Periodicals, and First-Class Mail.

Alliance support for the PRC Proposal:

- The reporting of on-time service performance and actual delivery days in the Public Performance Dashboard of nonprofit Marketing Mail (“NPMM”) separately from commercial Marketing Mail and of nonprofit Periodicals separately from commercial Periodicals (proposed 39 C.F.R. § 3055.102(i));

- The reporting of on-time service performance and actual delivery days in the Public Performance Dashboard of Political mail and Election mail separately from NPMM and separately from each other (proposed 39 C.F.R. §§ 3055.102(f); (g)); and

- The separate reporting of on-time service performance and actual delivery days in the Public Performance Dashboard of First-Class Single-Piece Reply Mail, which is used extensively by nonprofit mailers (proposed 39 C.F.R. § 3055.102(h)).

Alliance suggested enhancements to the PRC Proposal:

- As we did in our comments to the Advance Notice, the Alliance again urges the Commission to require the Postal Service to report service performance for “regular” NPMM separately from Political and Election mail. Most Political mail (e.g., campaign, issue, and candidate advertisements) and Election mail (e.g., ballots) is sent via NPMM. However, Political mail and ballots serve different purposes than do other types of Marketing Mail that qualify for reduced nonprofit rates, and they are subject to different service treatment than are “regular” nonprofit Marketing Mail pieces. The Alliance requests that the final rules include a separate service performance reporting category for nonprofit mail (within the USPS Marketing Mail class) that excludes both Political and Election mail.

- Furthermore, the Alliance reiterates its request that First-Class Mail generated by nonprofit mailers be measured and reported separately in the dashboard from First-Class Mail generated by commercial mailers. As the Alliance explained in our comments to the Advance Notice, nonprofit organizations use First-Class stamps on outbound and/or response letters and purchase Business Reply Mail to increase response rates for fundraising solicitations. The value of the Public Performance Dashboard would be enhanced if on-time service performance and actual delivery days were measured and reported for nonprofit-generated First-Class Mail separately from commercially generated FCM. We request that the final rules incorporate this service performance reporting requirement.

We will keep you posted.

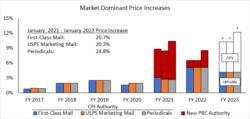

USPS rate hikes January 2021- January 2023

We finish with a table prepared by our longtime partners at Quad. It is shocking how much USPS will have raised rates by this January. 3-1/2 year totals range to 49%. (Click to enlarge.)

Source: Quad

And USPS isn’t done with massive 2023 rate increases. The potential range for July 2023 is wide with much inflation and regulatory uncertainty. (Click to enlarge.)

Leave a Reply