1. USPS Reports $1.5 billion Q1 Loss with 4.1% Lower Mail Volume Following Record Rate Increases

Budget vs. Service

Back before the Delivering for America plan, USPS management had an unofficial belief that each fiscal year was either a “budget year” or a “service year.” The agency rarely has achieved excellence in both financial performance and delivery service at the same time. Of course, no real business can succeed without achieving budget and service commitments concurrently.

Cost of Service

The service vs. budget cycle became embedded during the 36-year period in which the Postal Service operated under a cost of service pricing regime that evolved into a roughly three-year rate cycle (1970-2006). At the beginning of each cycle, the agency would be flush with cash and usually delivered better service. With a cash flow focus, finances were not much of a concern when the money was flowing.

As the third year of the cycle began, the Postal Service would find cash much tighter and would focus on the budget. It also would be making the case in a ten-month public process at the Postal Rate Commission that it needed a new rate increase to cover ever-escalating costs.

Price Cap

The 14-year era under the price cap regime administered by the Postal Regulatory Commission did not wean the agency from its budget vs. service dichotomy (2007-2020). The USPS never accepted that it should or ultimately would operate under the Consumer Price Index cap that Congress ordered in 2006. It spent most of the 14 years arguing against the cap and working furiously to have it overturned. The PRC capitulated in 2020.

DFA has not Cracked the Service vs Budget Code

Today’s release of the Quarter 1, Fiscal Year 2022 results shows that the Delivering for America team has not cracked the code about succeeding with budget and service at the same time. Q1 was a service quarter, as the DFA team wanted to show that it could do much better than the 2020 holiday season, albeit with lower volumes.

USPS did improve service in comparison to a very low base last year. Dr. Joshua Colin, Chief Retail & Delivery Officer and Executive Vice President, was very happy to give the service presentation at today’s Board of Governors meeting. At one point he proclaimed proudly that service performance for Marketing Mail was the best it has been since 2012. Of course, the corollary is ten years of lesser service in the intervening years.

Poor Financial Results

Financial results were not so good in Q1 as USPS threw money at improving holiday season service by hiring tens of thousands of temporary and permanent employees, deploying more package sorting equipment, and leasing 45 extra warehouse facilities.

USPS reported a loss of $1.5 billion in its highest volume quarter of the year, October-December. This is the quarter in which retailers normally make their profit for the year.

The Postal Service’s operating revenue was $21.3 billion for the quarter, a decrease of $202 million, or 0.9 percent, on a volume decline of 1.5 billion pieces, or 4.1 percent, compared to Q1 last year.

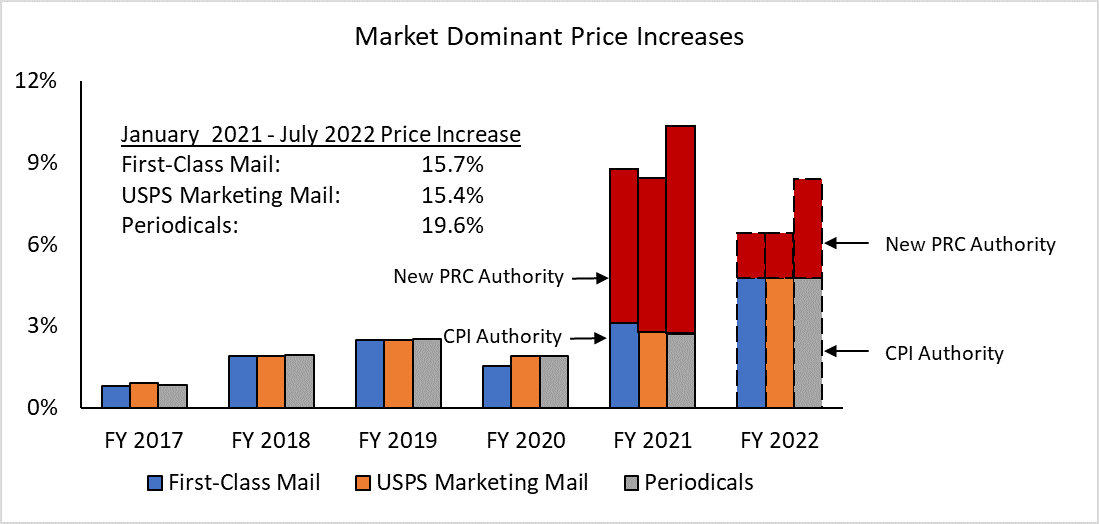

USPS enjoyed a First-Class Mail revenue increase of $160 million, or 2.5 percent, despite a volume decline of 529 million pieces, or 3.8 percent. The recent record rate increases enabled by the PRC helped the monopoly provider to book higher revenues. The agency’s finance chief, Joseph Corbett, Chief Financial Officer and Executive Vice President, attributed the volume decline to external factors, not to the large price hikes. There is no way to separate the causal factors although the twin postal agencies employ elaborate price elasticity models.

USPS Marketing Mail revenue increased $304 million, or 7.3 percent, in the face of a volume drop of 710 million pieces, or 3.6 percent. The greater increase in revenue compared to the volume decline is what the PRC and USPS bank on when they impose much higher than inflation rate hikes. A monopolist can count on that in the short run in a market dominated by businesses and organizations that rely on the product and take some time to implement alternatives. The long-run will not be as sanguine.

True believers in DFA, which includes the Board of Governors and all of USPS senior management, think that within a few short years package revenue will eclipse mail and will be the avenue to financial success. Q1 did not deliver that result. Package revenue decreased by $738 million, or 7.9 percent, on a volume decline of 210 million pieces, or 9.7 percent. Basing the future health of a critical national public service on success in the hyper-competitive package market seems a bridge too far.

Postal Service total operating expenses increased $1.7 billion in Q1 or 7.9 percent. When it makes things seem better, USPS likes to point out that non-cash workers’ compensation adjustments added to losses. Excluding them in Q1, total operating expenses increased $782 million, or 3.6 percent. That still sounds like a lot in comparison to a volume decline of 4.1 percent.

Are you a DFA True Believer?

Depending on whether you are a DFA true believer or a skeptic, the statement by the USPS CFO could be a voice of hope or a declaration that this agency cannot succeed as a standalone business:

“Despite the record package volume during the holiday season, the overall surge in e-commerce has begun to subside,” said Chief Financial Officer Joseph Corbett. “This shift in market trends, along with the continued declines in mail volumes, our increasing costs, and general economic conditions creating inflationary pressure, highlight the ongoing financial challenges that the Postal Service faces. While we continue to adapt to efficiently manage our business, invest in our infrastructure and our people, and optimize our network, our Delivering for America plan must be fully implemented, including legislative changes, to restore the Postal Service to financial sustainability.”

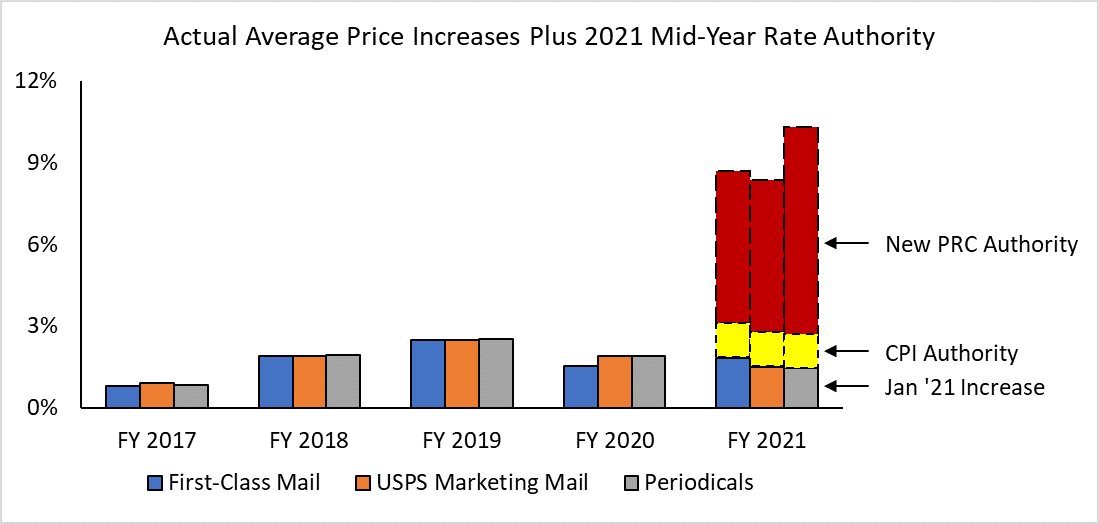

As a mailer, please do not forget the magnitude of rate increases that the DRF relies on. With the increases projected 5-1/2 months from now, the first 18 months of the new PRC rate regime will add up to 15-20 percent in monopoly product price increases.

2. House Voting to Approve Postal Service Reform Act Today

USPS has shown that it can benefit financially from record rate hikes for monopoly captive customers, at least in the short run. It now is enjoying a legislative push to give it approximately $50 billion in Congressional relief over ten years.

$50 billion Congressional Relief

The main action of the Postal Service Reform Act is to save USPS money on its retiree health insurance obligations by requiring all new postal retirees to use Medicare as their primary insurance. Historically, about one-fourth of postal retirees have not opted for Medicare. The bill saves more money by repealing the rapid pre-funding requirement for projected retiree healthcare costs.

Concerning Section

The bill includes a section that is concerning mailers. It was placed at the initiative of package shippers who are fighting a regulatory push by UPS to make USPS attribute more costs to package services. Currently, about two-thirds of postal costs are considered “institutional” and therefore not attributed directly to any product. Placing more costs in the package bucket might lead to higher rates for packages that already have experienced large increases.

Like a lot of things postal, we won’t know if or how bad Section 202 is for mailers until the damage occurs. For example, there might be unintended consequences combining mail and packages when separation would be more efficient.

The very general section seems to fix a problem that does not exist. That is, no one is trying to set up separate networks or to reduce six-day delivery. It reads:

SEC. 202. INTEGRATED DELIVERY NETWORK.

Section 101(b) of title 39, United States Code, is amended by

inserting before “The Postal Service” the following: “The Postal

Service shall maintain an integrated network for the delivery of

market-dominant and competitive products (as defined in chapter 36 of

this title). Delivery shall occur at least six days a week, except

during weeks that include a Federal holiday or in emergency situations,

such as natural disasters.”.

The Real Problem

The real problem with the bill is that there is no assurance or even likelihood that the $50 billion savings will be shared with mailers. The DFA plan includes both the legislative savings and the above-inflation rate hikes. The questionable reliance on future package growth, illustrated in Q1 results, likely will mean continued monopoly use of PRC-granted pricing power that drives down the volume but still yields more money, at least in the short-term.

Come to think of it, USPS has rarely not used its full rate authority since 1970. The most notable time was after the passage of the 2006 law when management decided not to level set rates to capture previous losses. Postal management and unions have been trying to claw that opportunity back at the PRC, the appeals court, and Congress. Given the “ongoing financial challenges” noted by the CFO today, the agency cannot be counted on to give rate relief in the foreseeable future. That is, as long as it tries to operate as a self-funding business.

On to the Senate

After House’s passage, the Postal service reform Act will move to the Senate where the Oversight Committee has already introduced an essentially identical bill. So its passage into law is likely. More’s the pity that Congress and the Administration will be able to say that they gave USPS and its customers postal reform. The opportunity for true reform will be even less than it has been.

3. Ordering, Fulfillment, and Delivery of COVID Tests

At today’s USPS Board of Governors meeting, a Governor remarked that fulfillment could be a good new business line for the agency. This followed glowing remarks by the Board about how USPS stepped up to provide online ordering, fulfillment, and delivery of four free COVID test kits per family that orders.

Three weeks after going live, many kits have been delivered but many have not, including some of those ordered right at the beginning.

Is it a Business Product or an Essential Government Service?

If USPS strives to add online ordering and fulfillment for others as a business line, it will be moving into an area already well covered by the private sector. The Postal Regulatory Commission should hold regulatory proceedings for new products that would ensure fair competition and profitable cost coverage.

Unless the new product line is limited to special government situations, the private sector is likely to object and lobby the PRC and Congress to prevent incursion into their markets by the government. If the USPS role were limited to government emergencies or the like, the remuneration would be greatly limited.

The COVID kit experiment could be a test of the opportunity to add new sources of revenue. More likely, it will be an affirmation that the USPS is a national security public service agency that should not be run as a standalone business.

4. USPS Delivery Fleet

In the early months of his tenure, the embattled Postmaster General made a big deal about the announcement of a multi-billion dollar contract award to Northrup Grumman Defense. In truth, the procurement process had been going on for years. It was a chance for the PMG to show that he was a man of action and this was the first big component of his much-anticipated ten-year plan.

The USPS procurement process is cautious and risk-averse. It is not designed to be transformational or leading edge. Being the first major fleet to make a major commitment to electric vehicles is not in the USPS procurement DNA. So, the agency announced a mostly traditional internal combustion fleet to be provided by a massive defense contractor. This decision was most likely baked in the cake well before the current PMG arrived on the scene.

Unfortunately for the contract, but perhaps fortunately for our earth, the inflection point for electric vehicles arrived in the ensuing months after the contract announcement. Private sector providers of delivery services in the US and abroad, have largely committed to an electric vehicle future. Some already are taking delivery of EVs.

The Democratic administration set goals to reduce carbon emissions that depend on the removal of internal combustion government vehicles, of which the postal fleet comprises about one-third. Last week, the administration sent two detailed letters to USPS objecting to the gas-powered plan and insisting that it be redone to create a mostly electric fleet.

The Postal Service issued an unusual Sunday press release that was confusing about its intentions. It said USPS will only buy electric to the extent it is “fiscally responsible.” The agency said it would include 5,000 EVs in its order and would strive to achieve a mostly electric fleet.

But it cautioned that as a self-funding business USPS doesn’t have enough money to do what the likes of Amazon, UPS, FedEx, and DHL are doing. The release said it could only meet the administration’s goals if multi-billion relief funding were provided by the government.

What’s More Important?

Like the COVID test kits, the questions around the USPS fleet raise the issue of what is more important—running the agency as a self-funding business or achieving national security, health, safety, and environmental goals and imperatives.

Ending the self-funding business experiment would entail a return to the longstanding practice of annual government subsidies to cover the public service, non-businesslike functions performed by the agency. It also would relieve the excessive burden now placed on captive mailers of USPS Market Dominant products. Mailers should not have to and cannot afford to cover the costs of the public service functions that competitive businesses do not provide. The longer we wait, the more mail leaves the system in reaction to excessive rates and unreliable service.

Leave a Reply