February 9, 2024

Copyright 2024 Alliance of Nonprofit Mailers

Projecting rates through 2025

The Postal Service recently shared projections for upcoming average rate increases for “compensatory” products:

Projected average USPS rate hikes for compensatory mail

July 2024: +7.7%

Jan 2025: +1.2%

July 2025: +7.3%

The January increases include only the effect of increases in the Consumer Price Index, the cap that Congress imposed in the 2006 Postal Accountability and Enhancement Act. The July rate hikes include CPI plus add-ons created by a November 2020 administrative ruling by the Postal Regulatory Commission.

The add-ons include 1% to better pre-fund retiree benefits and a complicated “density” formula to reward USPS for prior-year mail volume declines. Non-compensatory products such as Marketing Mail Flats get another 2%+ add-on every six months while non-compensatory classes such as Periodicals get 2% more every July.

The fact that the PRC add-ons are resulting in rate increases over 6 times higher than CPI for products that already cover their own cost indicates that the administrative changes need further review. In addition, the PRC did not anticipate that USPS would unilaterally decide to compound rate increases every six months, increasing the damage.

We translated the USPS percentage increase projections to likely ranges for the one-ounce First-Class Mail Forever stamp rate. The stamp price is very important to nonprofits that receive much of their revenue stream through First-Class Mail paid for either by the nonprofit or the responding donor, member, or subscriber.

One-ounce First-Class Mail Forever stamp rate

July 2024: 72 to 74 cents

Jan 2025: 73 to 75 cents

July 2025: 78 to 81 cents

When Louis DeJoy was appointed by the USPS Governors to be Postmaster General in May 2020, the First-Class stamp rate was 55 cents. Using the new rate authority granted by the PRC administratively a few months later, Mr. DeJoy has raised rates relentlessly and we believe imprudently. The “pricing strategy” has only one guiding factor: use all the authority the PRC grants. As a result of this irrational strategy, mail volume has plummeted much more than it had been trending, and USPS operating revenue growth has ground to a stop.

The 5-year increase from 55 to 81 cents would be 47%, while 78 cents would be a 42% escalation.

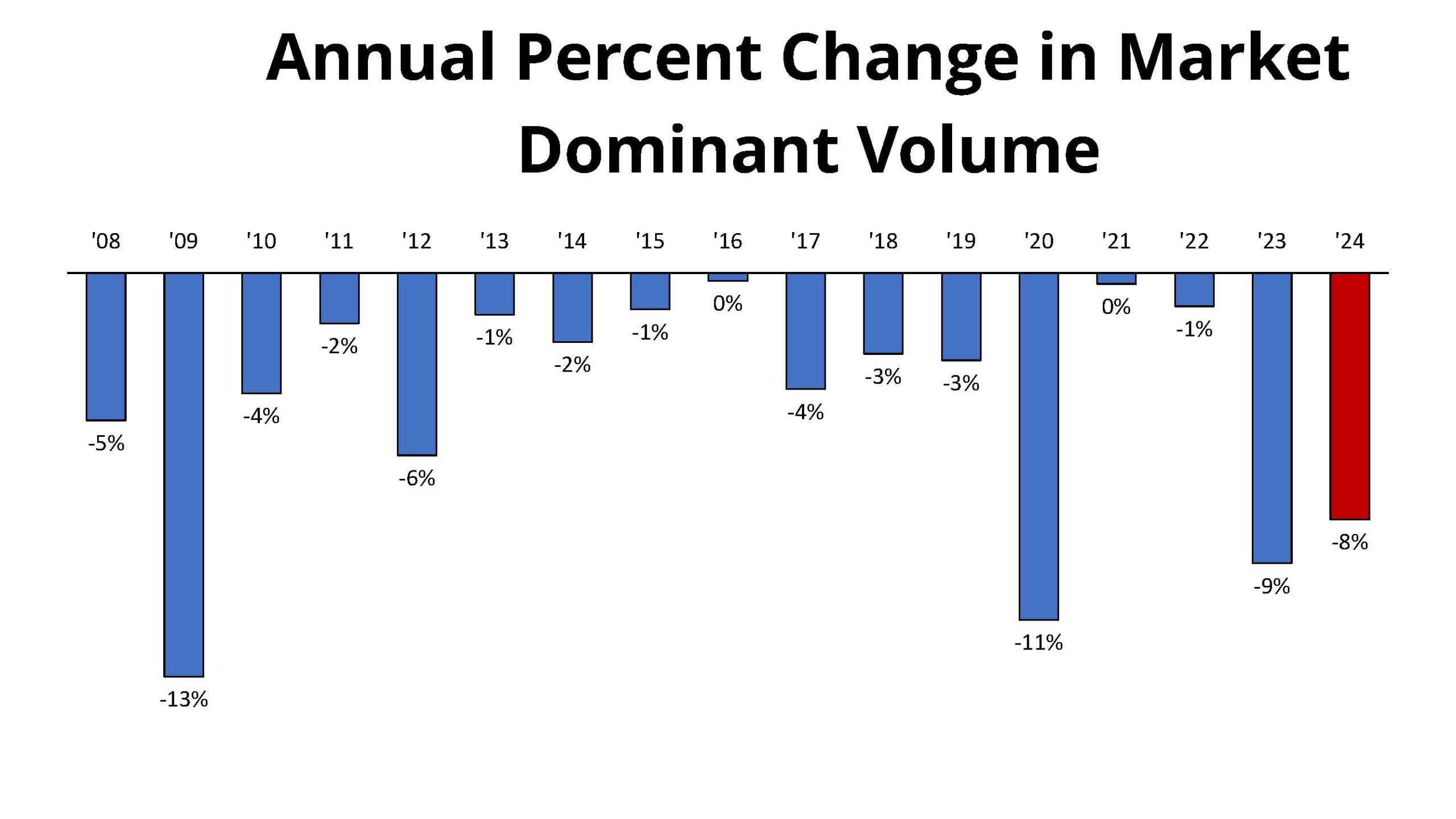

FY 2023 & 2024 setting records for largest mail volume declines without an external crisis

In fiscal year 2023, USPS market-dominant mail volume fell 9%, and it is projected by the Postal Service Integrated Financial Plan to decline by 8% this year. Looking back over the era of mail volume declines, there have been only two years that experienced larger mail volume declines than the latest two, and they both were driven by massive external disruptions.

The Great Recession drove volume down by 13% in FY 2009, and the COVID-19 pandemic led to an 11% drop in FY 2020. The other “non-crisis” 13 years between FY 2008 and FY 2022 experienced an average mail volume down 2.4%. In five of those years, volume dropped 1% or less. FY 2021 and FY 2022 were years in which the economy and mail recovered from the shutdowns and uncertainty of the pandemic.

The USPS pricing strategy is a major factor, along with an unfounded fear of a recession, that is driving the record mail volume declines in FY 2023 and FY 2024 to be greater than the longer-term trend. The declines in these two latest years are roughly 3 times the “non-crisis” average annual reductions of 2.4%.

2008-2024 MD Vol Percent Change

USPS service performance continues to be dismal in January

The Postal Service confirmed what mailers know from their own experience: that the agency’s service performance continues to miss the 95% on-time goal and is getting worse:

“FY24 second quarter service performance scores covering January 1 through January 26, included:

- First-Class Mail:7 percent of First-Class Mail delivered on time against the USPS service standard, a decrease of 3.2 percentage points from the fiscal first quarter.

- Marketing Mail:2 percent of Marketing Mail delivered on time against the USPS service standard, a decrease of 1.5 percentage points from the fiscal first quarter.

- Periodicals: 80.2 percent of Periodicals delivered on time against the USPS service standard, consistent with performance from the fiscal first quarter.”

The Postal Service blamed the weather for its failure to make the performance commitments:

“USPS delivery was impacted in broad areas across the country due to industry-wide disruptions in both ground and air transportation caused by winter storms. The Postal Service continues to restore service in these areas as quickly and as safely as possible, however, service performance may be negatively impacted as the weather systems continue through the month of January.”

Some parts of the country are experiencing particularly bad service which seems caused by the implementation of new USPS facilities under its ten-year plan. The Houston area has experienced huge delays in mail and packages because of backups in the Missouri City facility. Several members of Congress representing the affected area have been demanding answers from the Postal Service but have expressed dissatisfaction with the level of transparency exercised by the mail agency.

Much of the discussion among members of the Mailers Technical Advisory Committee at its recent meeting was about terrible service. But members were also reeling from the shellacking they received from the Postmaster General in his opening 90-minute harangue. Mr. DeJoy gave the same speech he had been delivering for months, but this time with PowerPoint slides and much more anger and recrimination. He placed MTAC on the same enemies list that includes the Postal Regulatory Commission and the Office of Inspector General.

SnailWorks, which tracks millions of customer mail pieces, shared their January data with a one-year comparison:

“For some context, in January of 2023, First-Class letters and flats were delivered on time 91.9% and 83.4% of the time, respectively. In January 2024, the on-time percentages for those two types of mail were 82.6% and 68.8% respectively. On average it took about .7 days longer for either to be delivered.”

Former Postmaster General Anthony Frank (March 1, 1988-July 6, 1992), who like DeJoy was a private sector businessman, used to say that fixing the Postal Service is like repairing an airplane while it is flying. If the current fixes being implemented at the agency are truly long-term fixes, they are causing much turbulence and loss of altitude in the short run. They need to focus more on keeping the plane in the air.

|

|

USPS lost $2.1 billion in its peak quarter, Oct.-Dec. 2023

The Postal Service posted a loss of $2.1 billion in its strongest mailing and shipping quarter, the first quarter of fiscal year 2024. This came on increases in operating revenue of 0.5% and operating expenses of 4.9%.

First-Class Mail volume declined by 704 million pieces, or 5.6 percent, compared to the same quarter last year, as revenue increased $171 million, or 2.6 percent. Marketing Mail volume declined by 2.4 billion pieces, or 13.5 percent while revenue decreased by $235 million, or 5.4 percent. The Postal Service attributed a lot of the MM decline to cyclical election and political mail without which there would have been a decrease in volume of 1.1 billion pieces, or 6.2 percent, and an increase in revenue of $40 million, or 0.9 percent.

In any case, revenue growth for mail was a small fraction of the rate increases imposed by the Postal Service.

Package shipping revenue increased $240 million, or 2.7 percent, on a volume increase of 98 million pieces, or 5.1 percent. USPS needs much more growth in packages to achieve its strategic goal of financial stability.

The USPS Integrated Financial Plan for FY 2024 projects a loss of $6.3 billion. To achieve that loss the agency plans for an increase in revenue of $2.4 billion (3.0%) compared to FY 2023. Virtually all of the increase in revenue is earmarked to come from packages.

In sum, the first quarter increase in revenue is 0.5% while the annual plan calls for a 3% growth in revenue to limit the loss to $6.3 billion.

Issued February 6, 2024, at the University of Chicago.

Leave a Reply